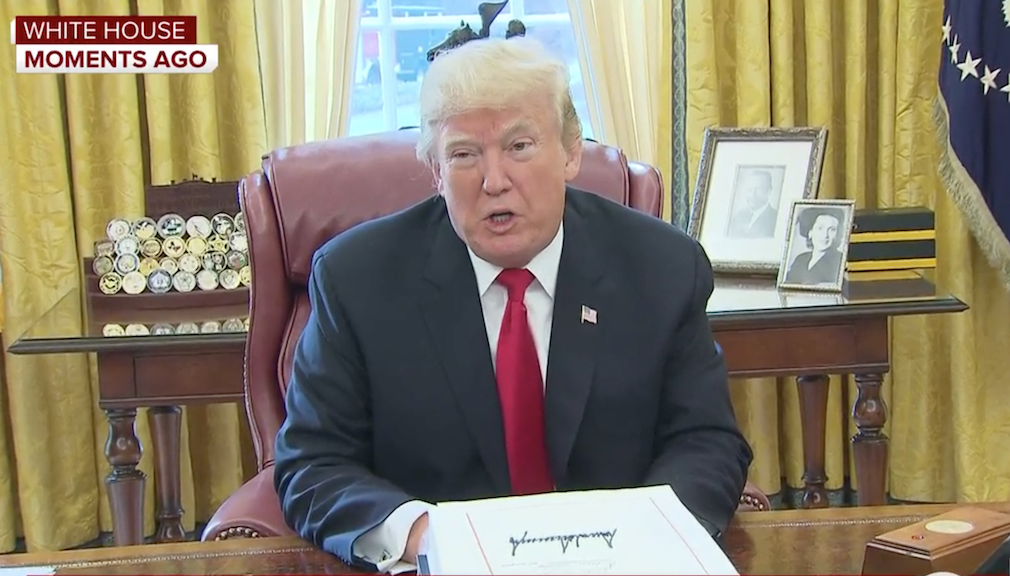

Friday morning, President Donald Trump announced he would sign the sweeping tax reform bill into law, marking the first major legislative victory in his term.

Will be signing the biggest ever Tax Cut and Reform Bill in 30 minutes in Oval Office. Will also be signing a much needed 4 billion dollar missile defense bill.

— Donald J. Trump (@realDonaldTrump) December 22, 2017

The signing was held in private in the Oval Office, and the White House event to celebrate the new law will be held in the new year on January 3, 2018.

During the signing, Trump boasted of the victories of his presidency, saying “We have more legislative victories than any other president.”

Trump congratulated the Republicans in the House and Senate for passing the bill, but said Democrats “don’t want tax cuts,” and that they would regret not being part of the tax law’s passage.

Trump held a celebratory conference to announce the passage of the tax reform bill into law Wednesday afternoon after the Senate voted on it early Wednesday morning, and the House revoted Wednesday afternoon.

Unlike previous versions of the law, the mortgage interest deduction to was cut to $750,000, down from the current $1 million, but up from the House’s proposed cut to $500,000.

One selling point of the final version to the housing industry is that it kept the capital gains provision intact. This provision allows married couples filing their taxes jointly to exclude up to $500,000 in capital gains on the sale of a home, as long as they have used it as a primary residence for at least two of the last five years, while an individual can exclude up to $250,000.

The House and Senate each proposed to make this rule more strict, however neither provision made it through the final committee, and the rule will remain the same.

And to celebrate the passage of tax reform with the corporate tax rate cut from 35% to 21%, several companies, including two banks, announced they would share the cut by raising wages for their employees.