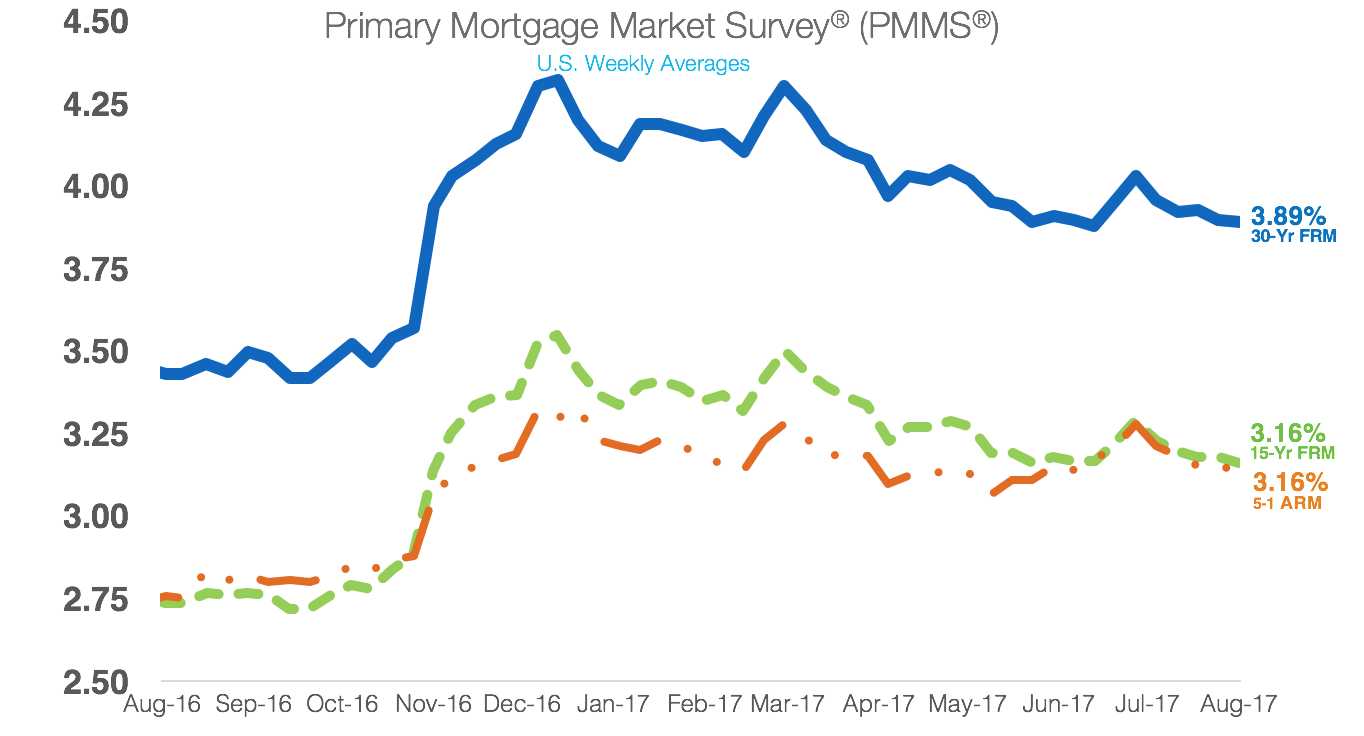

Mortgage rates remained largely unchanged this week amidst the lingering sense of economic uncertainty, according to the weekly Primary Mortgage Market Survey from Freddie Mac.

“Following a mild decline last week, the 10-year Treasury yield rose 1 basis point this week,” Freddie Mac Chief Economist Sean Becketti said. “The 30-year mortgage rate similarly remained relatively flat, falling just one basis point to 3.89%.”

Click to Enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage dropped one basis point to 3.89% for the week ending August 17, 2017. This is down from last week when mortgage rates hit 3.9%, but up from last year’s 3.43%.

The 15-year FRM also decreased slightly, hitting 3.16% for the week. This is down from 3.18% last week, but up from 2.74% last year.

However, the five-year Treasury-indexed hybrid adjustable-rate mortgage increased to 3.16%, up from 3.14% last week and 2.76% last year.

“Mortgage rates are continuing to hold at low levels amidst ongoing economic uncertainty,” Becketti said.

Although most economists predicted the Federal Reserve will raise rates three times in 2017, weak economic data is now leading some experts to say the chance of a third rate hike in December is less certain.