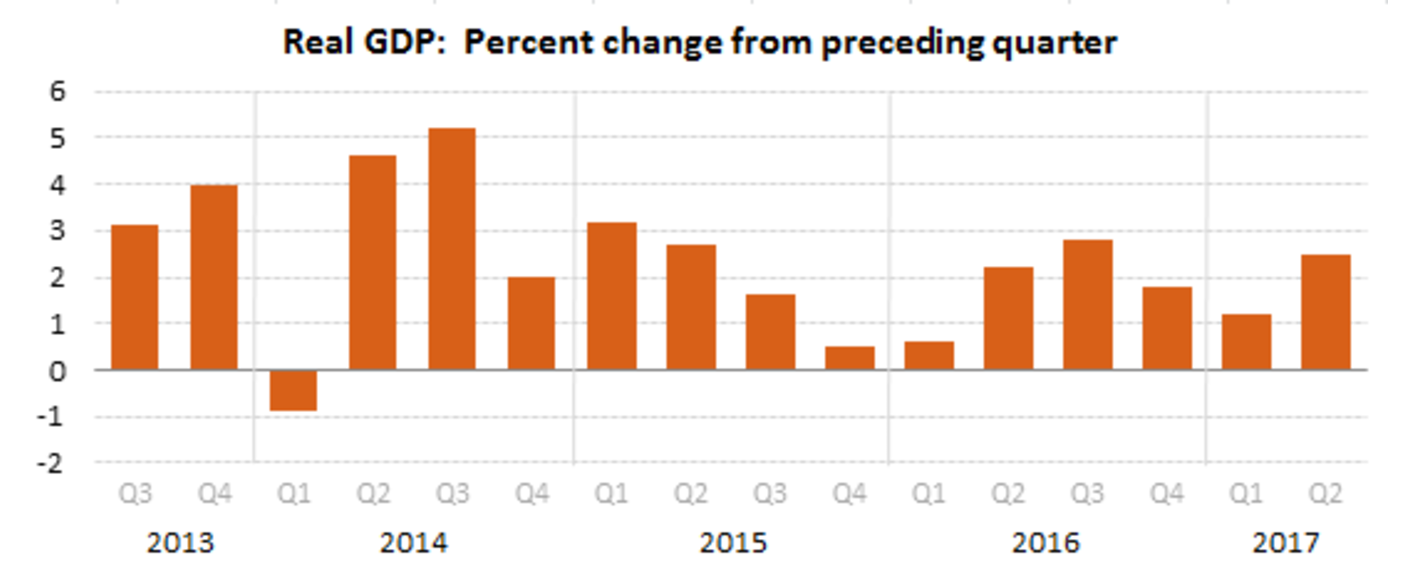

The U.S.’s gross domestic product picked up steam in the first quarter as it more than doubled from the first quarter, according to the advanced estimate from the Bureau of Economic Analysis.

Real GDP increased at an annual rate of 2.6% in the second quarter this year. This is up from the first quarter’s downwardly revised 1.2%.

The second quarter advanced estimate is based on source data that is incomplete or subject to further revision, and will be followed by a second estimate released in August.

Click to Enlarge

(Source: BEA)

The increase in real GDP in the second quarter reflected positive contributions from personal consumption expenditures, nonresidential fixed investment, exports and federal government spending which were partly offset by negative contributions from private residential fixed investment, private inventory investment and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased.

Current-dollar GDP increased 3.6%, or $169 billion, in the second quarter to a total $19.23 trillion. This is up from the first quarter’s increase of 3.3% or $152.2 billion.

The gross domestic price purchase index increased 0.8% in the second quarter, down from the increase of 2.6% in the first quarter. Personal consumption expenditures increased just 0.3%, down from last quarter’s increase of 2.2%.

One expert explained this rebound in GDP shows the economy is still on a strong path, and confirms the likelihood of one last rate hike this year.

“Looking ahead, the strengthening labor market should continue to support real consumption growth, while the business surveys remain at a high level and suggest that investment will continue to recover,” Capital Economics Economist Andrew Hunter said. “Accordingly, we still expect GDP growth of 2.5% to 3.0% over the rest of this year which, along with the declining unemployment rate, should leave the Fed on track to raise interest rates once more before year-end.”