In the first quarter of 2017, refinances fell 45% from the fourth quarter, however the second and third quarters could see a turnaround in refi activity, according to a first look at Black Knight’s soon to be released Mortgage Monitor.

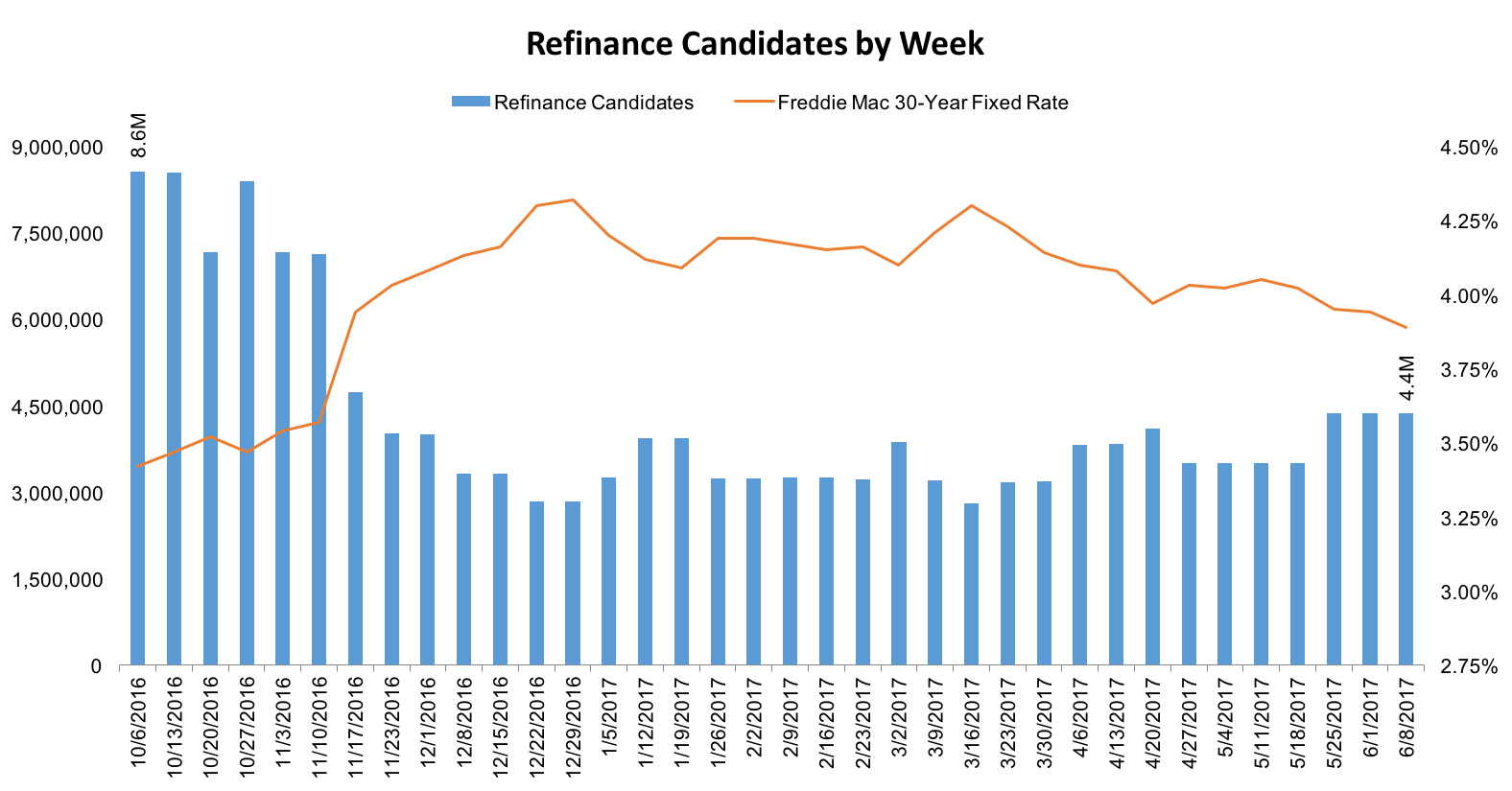

This chart shows refinance activity each week from October through June as refinance candidates fell from 8.6 million to 4.4 million.

Click to Enlarge

(Source: Black Knight)

Since interest rates fell below 4%, the financeable population rose to its highest point for 2017. While the current 4.4 million borrowers is down significantly from October, it is an increase of 56% or 1.6 million borrowers from mid-March’s low.

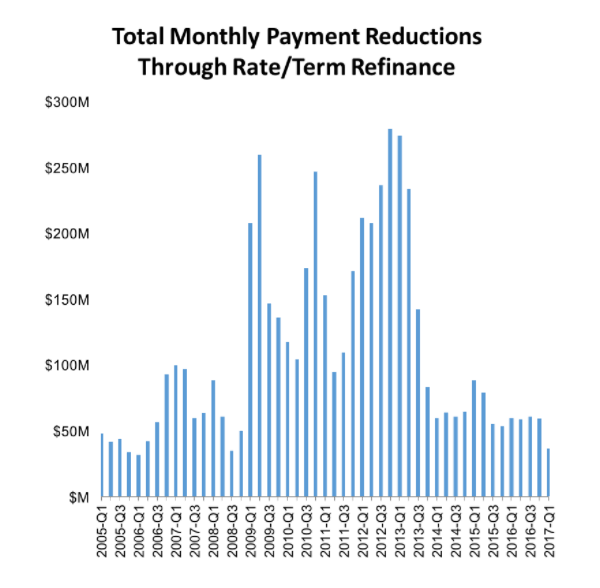

Borrowers who refinanced in the first quarter of 2017 cut their monthly mortgage payments by an average of $109 per month, or a total aggregate savings of $36.5 million per month. This marks the lowest total monthly savings since 2008 and a decrease from the fourth quarter’s $59 million.

But since the first quarter, savings have increased once again to a total of $1.1 billion or $260 per borrower each month.

This chart shows the total monthly savings borrowers saw each month through refinancing their mortgages dating back to the first quarter of 2005.

Click to Enlarge

(Source: Black Knight)