BEN CARSON

BEN CARSON

Ben Carson was officially confirmed as secretary of the Department of Housing and Urban Development on March 2. A few days later, in his first speech to HUD employees, he referred to slaves as immigrants, causing a media uproar. Later that day Carson sought to clarify his remarks, saying, "The slave narrative and immigrant narrative are two entirely different experiences… The two experiences should never be intertwined, nor forgotten, as we demand the necessary progress towards an America that's inclusive and provides access to equal opportunity for all."

APPRAISERS: THEY’RE STILL NEEDED

The future of home valuation is a topic that weighs heavy on appraisers, understandably. Both the GSEs have expanded the use of automated models and made other appraisal changes. So HousingWire’s March webinar on the state of the appraisal industry opened with the big question: Will technology replace appraisers? The panel of industry experts included Zach Dawson, Fannie Mae's director of collateral strategy, who made it clear that technology could enhance but not supplant human appraisals.

CUSTOMER SATISFACTION WITH BANKS

Retail bank, mortgage and financial services firms saw a five-year trend of consistently improving customer satisfaction, but perception of excessive sales pressure now threatens that trust, according to J.D. Power's new report: Customer Views on Sales Practices in Financial Services. Despite the pressure since the financial crisis, customer satisfaction hit record highs, as seen by metrics that track customer loyalty, bank reputation and repeat usage. In fact, loyalty is so high that even after Wells Fargo's scandal, 82% of retail bank consumers say they trust their bank to do the right thing.

WELLS FARGO BONUSES

WELLS FARGO BONUSES

Wells Fargo announced March 1 that it plans to claw back the cash bonuses for eight of its top senior executives, including the bank’s new CEO, Tim Sloan, as the fallout from the bank’s fake account scandal continues. According to the bank, the revocation of the senior executives’ bonuses are “not based on any findings of improper behavior in the board of directors’ ongoing independent investigation” into how 5,000 of the bank’s former employees opened as many as 2 million accounts without authorization in order to get sales bonuses.

MORTGAGE RATE/TREASURY YIELD CORRELATION

Since 2017 began, mortgage rates have yet to follow the 10-year Treasury yield. “For the last 46 years, the 30-year mortgage rate has been almost perfectly correlated with the yield on the 10-year Treasury, but not this year,” Freddie Mac Chief Economist Sean Becketti said. In the weeks that followed, the 30-year mortgage rate continued to chart its own course. “While we expect mortgage rates to fall into line with Treasury yields shortly, this just may be a year full of surprises,” Becketti said.

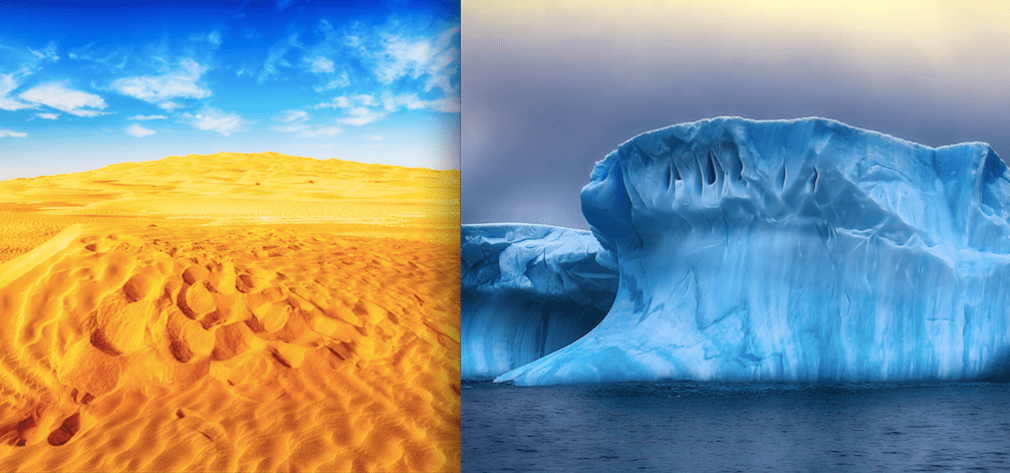

PARTISAN GAP

Democrats are expecting recession and Republicans are expecting robust growth, Surveys of Consumers Chief Economist Richard Curtin said. “Indeed, the difference between these two parties is nearly identical to the difference between the all-time peak and trough values in the Expectations Index – 64.6 versus 64.4,” he said. Curtain explained the expectations of Democrats and Republicans largely offset each other, and the overall gain in the Expectations Index was due to self-identified Independents, who were closer to the optimism of the Republicans than the pessimism of the Democrats.