Citing the need for additional time for testing and development to ensure a "smooth transition," the Federal Housing Finance Agency announced Thursday that the implementation of the single security.

This projected billion-dollar joint initiative from Fannie Mae and Freddie Mac will develop a single mortgage-backed security that will be issued by the government-sponsored enterprises. It is being officially pushed back until the second quarter of 2019.

Previously, the implementation of the second phase of the single security rollout was to take place in 2018, but the FHFA is pushing it back.

And the FHFA did more than update the timeline for the use of the single security on Thursday; it also unveiled the name for the single security and revealed how much the development of the single security is costing.

According to information provided by the FHFA, the delay is the result of an “extensive review of lessons learned” undertaken after the successful implementation of Release 1, the first phase of the single security rollout.

As part of Release 1, which was implemented late last year, Freddie Mac began using the Common Securitization Platform.

The Common Securitization Platform is the technology and operational platform that is being developed by Common Securitization Solutions, the company formed in 2014 by Fannie and Freddie to facilitate the design and implementation of the single government-sponsored enterprise mortgage bond.

Freddie Mac was first to implement the use of the CSP, using it for data acceptance, issuance support and bond administration activities released to current single-class, fixed-rate, mortgage backed securities.

When the FHFA announced the implementation of Release 1, it said that it expected the full implementation of Release 2 to be completed in 2018.

The second phase of the rollout, Release 2, will see both GSEs begin to use the data acceptance, issuance support, disclosure and bond administration modules to perform activities related to their current fixed-rate securities, both single- and multi-class; to issue Single Securities, including commingled resecuritizations; and to perform activities related to the underlying loans.

Now, after reviewing Release 1 and gauging the progress on the development of Release 2, the FHFA is pushing the full rollout of the single security to 2019.

“The drivers of this anticipated implementation date include the demonstrated need for additional time for the development, testing, validation of controls, and governance processes necessary to have the highest level of confidence that the implementation will be both smooth and successful,” the FHFA said in its release.

“The implementation of Release 1 demonstrates that the system, operations, and controls of CSS and the CSP are functional,” the FHFA said.

“This should provide greater assurance to market participants and policymakers that Release 2 will be successfully implemented,” the FHFA continued. “Just as Release 1 was a large and complex undertaking, Release 2 will be as well. In fact, Release 2 will entail additional complexity and challenges in that it will require close coordination with many market participants and vendors, as well as close attention to software development and back-office operations.”

As part of the announcement, the FHFA said that once the implementation of Release 2 is completed, Fannie and Freddie will begin to use the CSP to issue the single, common security, which will be called the Uniform Mortgage-Backed Security or UMBS.

Here are more details on Release 2, courtesy of the FHFA:

Release 2 will allow both Enterprises to use the Data Acceptance, Issuance Support, Disclosure, and Bond Administration modules of the CSP. The Enterprises will use those modules to perform activities related to their outstanding fixed-rate, single- and multi-class mortgage-backed securities, including the new UMBS and single- and multi-class resecuritizations of UMBS.

Single-class resecuritizations of UMBS (to be known as Supers) will be analogous to Fannie Mae Megas and Freddie Mac Giants, which are respectively single-class resecuritizations of Fannie Mae MBS and Freddie Mac PCs. Multi-class resecuritizations will include tranched securities such as collateralized mortgage obligations (CMOs) and real estate mortgage investment conduits (REMICs). Such resecuritizations may commingle UMBS or Supers originally issued by both Fannie Mae and Freddie Mac. The CSP modules will also be used to perform activities related to the loans underlying those securities. Additionally, Release 2 will allow the Enterprises to use CSS and the CSP to issue and administer certain non-TBA securities, including securities backed by adjustable-rate mortgages.

As part of the update, the FHFA also disclosed the cost of the development of the single security to this point.

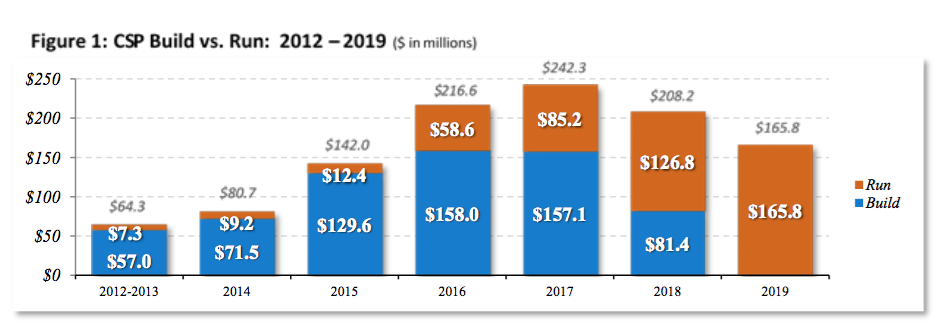

According to the report, since the single security project was first announced in February 2012, the GSEs have invested $454 million to develop the CSP and organize and initiate CSS operations.

The initiation of CSS, the company that is overseeing the implementation process, involved establishing its corporate functions, including corporate finance, enterprise risk management, information security, human resource management, and internal audit.

To this point, much of the projects costs have been tied to building the single security and the platform to deliver it. In 2016, for example, the GSEs spent $158 million on “build” expenses, which relate to the development and testing activities undertaken by CSS to enable the GSEs to use the CSP and the related infrastructure and operational processes.

Additionally, the GSEs spent $58.6 million in 2016 on “run” expenses, which relate to the activities undertaken by CSS to run the CSP and related processes for the GSEs and to operate CSS as a stand-alone business, including the ongoing support for the platform software and hardware in production, operation of securitization business processes, regular business continuity and disaster recovery testing, and ongoing implementation of CSS corporate functions.

According to the FHFA, the GSEs are projected to spend an additional $616.3 million between 2017 and the end of 2019 on the continued development of the single security.

Build costs are expected remain basically static for 2017, while run costs are expected to rise to $85.2 million.

In 2018, the cost spread is expected to reverse, with more money going to run expenses (an estimated $126.8 million) rather than build expenses (an estimated $81.4 million).

And in 2019, all the cost (an estimated $165.8 million) is expected to go to run expenses, as shown in the chart below.

(Click to enlarge)

The FHFA notes that upon the implementation of Release 2, CSS will be responsible for bond administration of approximately 900,000 securities, which are backed by almost 26 million home loans having a principal balance of over $4 trillion, so a properly functioning CSP is critical.

Between the $454 million spent so far on the single security project and the estimated $616.3 million that the GSEs will spend between this year and 2019, the total cost of the development of the single security will push past $1 billion.

But the FHFA said that it expects to make that money back quickly thanks to the cost savings that will come from the single security.

According to the FHFA, one of the key goals of the single security project is to reduce the costs to Freddie Mac and taxpayers that come from the “persistent difference in the liquidity of Fannie Mae MBS and Freddie Mac PCs.”

That “persistent difference in liquidity” imposed “significant annual costs” on Freddie Mac, and ultimately on taxpayers, the FHFA said, because it lowers the amounts available for dividend payments by Freddie Mac to the Department of the Treasury under the Senior Preferred Stock Purchase Agreement.

Under the Senior Preferred Stock Purchase Agreement, the GSEs send all quarterly profits to the Treasury.

According to the FHFA, Fannie and Freddie both issuing the UMBS rather than different securities should “recoup most, if not all, of the cost to the Enterprises of building the CSP and CSS” over time.

In fact, the FHFA currently projects that use of the UMBS will save $400 million to $600 million per year.

“The CSP and Single Security are ambitious projects. I am very pleased with the hard work and determination of all those involved who helped make Release 1 a success and laid the foundation for successful implementation of Release 2,” FHFA Director Melvin Watt said.

“I am also grateful for the support and input we have received from the public and from industry participants,” Watt continued. “I encourage all market participants to begin moving forward with their preparations to make the changes they will need to accompany implementation of the Single Security Initiative.”