HouseCanary, a data and analytics provider, launched a new rental market index to gauge returns for investors titled, HouseCanary Rental Investment Index (HCRI).

The timing of the new index falls right alongside the growing single-family rental home market, which is composed of nearly 20 million homes, and only growing thanks to several factors driving it. This includes an increase in lifestyle flexibility provided by leasing, declining home investment across the U.S., and tighter housing markets that have been influenced by credit availability.

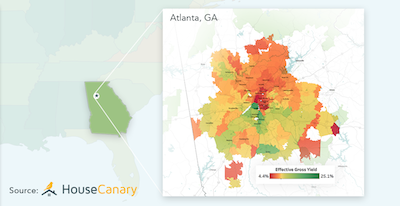

The HCRI Index measures effective gross yield for the industry, computed as the current fair market annualized rent minus estimated property tax, divided by the current fair market home value.

HouseCanary explained that effective gross yield is a valuable profitability metric for single-family rental home lenders and investors, who have historically only been able to calculate gross yields for individual properties or their own portfolio of properties.

"Given the massive size of the SFR market, separating the wheat from the chaff can be hard. The precision and richness of HouseCanary's data will help investors zero in on the areas that make the most sense for their investment strategies," said Gary Beasley, industry veteran and co-founder and CEO of Roofstock.

The company predicts that the new index, which will be available to all industry participants, will help drive investor interest in rental properties, accelerate financing, increase competition, and give renters more choice and better quality as more individual owners improve homes to compete with institutional owners.

The chart below gives a small preview of what the index is capable of. The one below pinpoints Atlanta.

Click to enlarge

(Source: HouseCanary)