While previous estimates showed cash and distressed sales hitting their pre-crisis marks in 2018 or even 2019, the newest report estimates that the market could see pre-crisis levels as soon as this Summer, according to a new report from CoreLogic.

Cash sales accounted for 32.4% of total home sales in November, which, while up from October’s 31.8%, is down 4.5% annually.

Before the housing crisis, cash sales averaged about 25%, a rate cash sales could hit by mid-2017 if the rate continues to fall at the same pace it did in November.

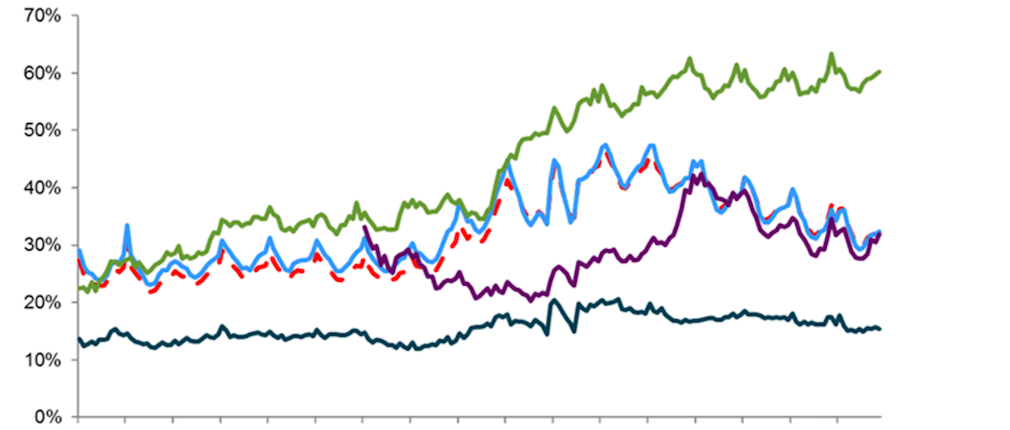

Real estate owned sales held the highest share of cash sales in November at 60.2%, followed by resales with 32.3%, short sales with 31.9% and newly constructed homes at 15.5%.

While cash sales make up many of the sales in the REO category, its share in the market continues to decrease. In fact, distressed sales made up 7.5% of the market share in November, the lowest share for any month since September 2007. Before the housing crisis distressed sales hovered near 2%. At the current annual rate of decrease, distressed sales could hit that mark by the end of 2017.

Most states, all but eight, saw decreases in their distressed sales, however some states continue to see higher rates than others. Maryland saw the largest share of distressed sales at 18.4%, followed by Connecticut with 18.2%, New Jersey with 15.8%, Illinois with 14.3% and Michigan with 14%.