This wordplay on the famous line from Shakespeare’s Hamlet is appropriate as the Federal Reserve contemplates whether or not it will resume raising the Federal Funds Rate Target.

The Fed Funds Rate is the rate that depository institutions (banks and credit unions) loan reserve balances to each other. Although it’s a very short-term interest rate, typically overnight, it has implications for many different sectors, including housing.

Ultimately, changes in the rate will percolate up to impact even the 30-year Treasury bond and 30-year residential mortgage rates.

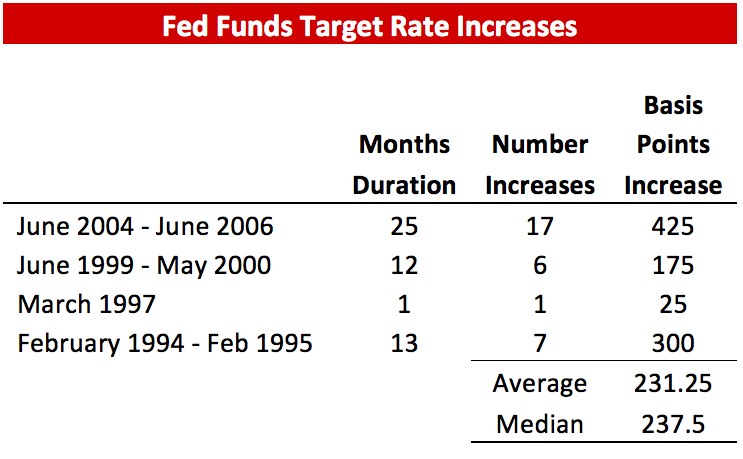

Just as appraisers use comparable sales and historical figures to determine current values, looking at the Fed’s previous actions show what the outcomes of a rate increase could have on the housing market. The previous four rate-rise cycles are shown in the following table. Over these four cycles, the Fed Funds Rate increased from 25 to 425 basis points, with a 231.25 basis point average.

Click to enlarge

(Source: Federal Reserve Bank of New York)

So what will the impact be on the typical homebuyer? If you take a look at Freddie Mac’s average 30-year residential rates, and compare that to historical federal interest rates, the average 30-year residential mortgage rate has been 290 basis points greater than the Effective Federal Funds Rate.

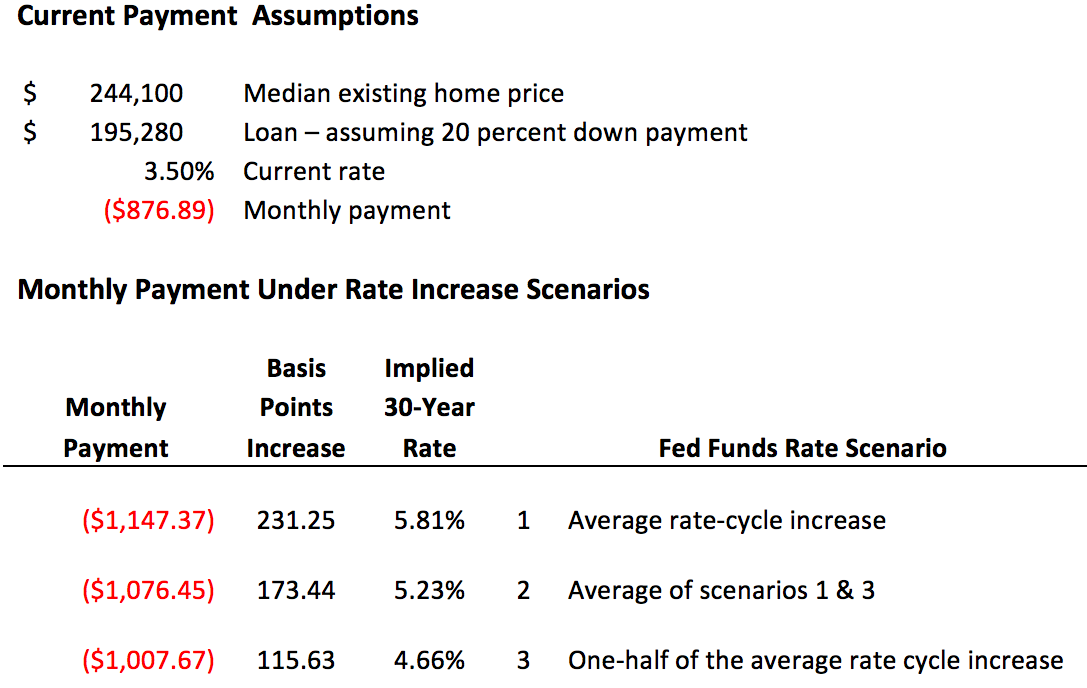

Knowing that, we can then use the current median existing-home price of $244,100, according to the National Association of Realtors, and the average 30-year fixed residential loan rate of 3.50%, according to Freddie Mac, to establish a good sense of how a Fed interest rate hike might impact mortgages.

Armed with this knowledge, here are three separate scenarios, corresponding to a 20% down loan, accounting for an increase in the Fed Funds Rate in the next 18 to 24 months:

Scenario 1 – Fed Funds Rate increase is 231.25 basis points

Scenario 2 – Fed Funds Rate increase is the average of scenarios 1 and 3

Scenario 3 – Fed Funds Rate increase is one-half the average of the past four rate increase cycles

Click to enlarge

Under these assumptions, the typical homebuyer will face an increased monthly payment ranging from $130 to $270.

Will such an increase hinder housing sales? Not likely, especially if median household income continues to rise and job growth remains steady or expands. Jobs are everything to an economy and ultimately housing markets.

Are these rate increase scenarios likely to occur? If history repeats itself, then yes. However, others disagree with rates rising to these levels.

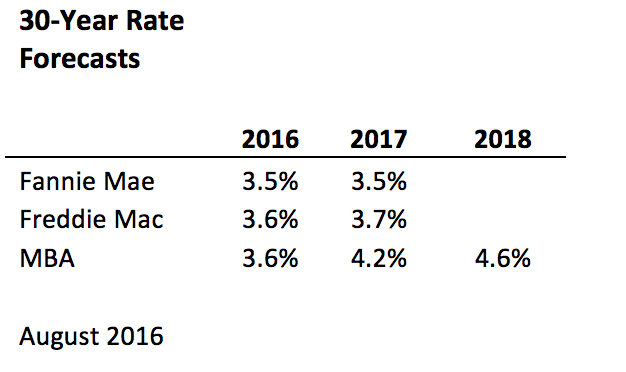

The last table shows the latest annual average 30-year residential rate forecasts from Fannie Mae, Freddie Mac and the Mortgage Bankers Association.

Each of the three organizations reduced interest rate forecasts following the BREXIT vote in the short and long term.

The drop in interest rate expectations following the BREXIT vote resulted in an average forecast increase in refinance lending volume across these three of $173 billion for 2016 (up 25 percent versus pre-BREXIT) and up $129 billion in 2017 (a 33 percent gain).

Click to enlarge

My expectation is for rising rates, though that has been muted temporarily by BREXIT. Homeowners that can benefit from refinancing today should act quickly. Prospective homebuyers should so likewise to participate in what are near record-low interest rates.