Irving, Texas-based residential mortgage origination and servicing company, Caliber Home Loans, continues to move into new growth territory.

Fitch Ratings announced the first rated non-prime, post crisis private-label securitization is being marketed using Caliber mortgages as collateral.

It's called COLT 2016-1, which means it's the first in an intended series of residential mortgage-backed securitizations to come.

The announcement is fairly spectacular as the private mortgage bond market is largely nonexistent, though the once, largest player Redwood Trust is said to be making a comeback following a lengthy hiatus.

At any rate, according to the pre-sale report: “Fitch reviewed Caliber’s and [asset manager] Hudson’s origination and acquisition platforms and found them to have sound underwriting and operational control environments, reflecting industry improvements following the financial crisis that are expected to reduce risk related to misrepresentation and data quality.”

Third-party due diligence verifies this claim. Borrowers also earn high incomes and the loan-to-value ratio is fairly decent, too.

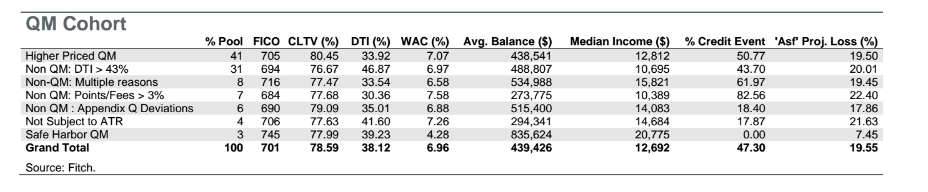

The credit ratings agency also raised a red flag on the high concentration of hybrid adjustable-rate mortgages and non-QM loans in the pools.

Here is a breakdown by non-QM loan type, click to enlarge:

Also, “Approximately 47% of the pool by unpaid principal balance (60% by loan count) had a prior credit event, including foreclosure, bankruptcy, short sale or deed in lieu of foreclosure.” However, the average borrower holds $230,000 in liquid reserves.

But Fitch said there are some concerns on the issuer side as well, which limited the strength of the rating; the highest pool is single-A.

“Due to the limited non-prime performance of the asset manager, Hudson Americas and originator, Caliber Home Loans, Fitch capped the highest possible initial rating at ‘Asf’. As more post-crisis non-prime performance is established while upholding appropriate controls, Fitch will consider a higher rating in the future.”

Earlier this year Caliber announced plans to acquire First Priority Financial, a regional residential mortgage lender with branches and originators serving California, Oregon, Washington, Idaho and Iowa.

HousingWire’s youngest 2016 Rising Star is Nicole Allison. Allison started working in lending to put herself through law school, but fell in love with the industry instead. A senior loan consultant at Caliber Home Loans, Allison grew business 23% year over year and more than 97% of her clients would refer her to family and friends.

For the latest RMBS deal there are some backstops. Wells Fargo Bank will act as master servicer and securities administrator. That means any advances required but not paid by Caliber will be paid by Wells Fargo.