Mortgage rates are forecasted to hover around the 4% level for about another year as the market awaits future Federal Reserve interest rate hikes, Mike Fratantoni, chief economist for the Mortgage Bankers Association, said in a press conference at the MBA Secondary conference in New York City.

Fratantoni expects there to be two rate hikes this year and four per year going forward. So far, the Federal Open Market Committee has raised interest rates only once in the past nine years, and it was back in December.

But even with the possibility of future Fed rate hikes, mortgage rates are not expected to start skyrocketing.

The MBA noted that its forecast is based on Freddie Mac’s 30-year fixed rate, which is based on predominately home purchase transactions.

Last week’s mortgage rate results from Freddie Mac posted that the 30-year mortgage rate is now at the lowest level in three years, creating a resurgence in refinance applications.

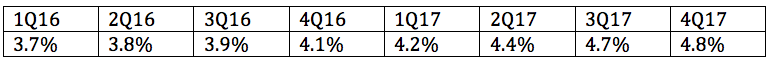

The chart below shows the MBA’s prediction for mortgage rates until fourth quarter 2017. It won’t be until have way through 2017 that mortgage rates start to hover above 4.5%.

Click to enlarge

As mortgage rates increase, the debate around the costs to originate a mortgage continue.

The MBA reported back in March that the net gain on each loan originated by independent mortgage banks and mortgage bank subsidiaries plummeted 60% in the fourth quarter of 2015 due to the implementation of the Consumer Financial Protection Bureau’s TILA-RESPA Integrated Disclosures rule in October.

“With the Know Before You Owe rule going into effect last October 3rd and declining production volume compared to the third quarter of 2015, mortgage bankers saw their total loan production expenses climb to $7,747 per loan, from $7,080 per loan in the third quarter,” said Marina Walsh, MBA’s vice president of industry analysis, at the time.

However, the nuances behind how long this will last and whether it expected to increase or decrease is still too early to tell, explained Fratantoni.

There are a lot of factors at play such as did lenders spend a lot more on compliance at the beginning for employees and tools, which will phase out as time continues or will those costs stick around.

Other key MBA forecasts include that mortgage originations will hit $1.6 trillion in 2016, a jump from the MBA’s previous forecast that mortgage originations will decrease to $1.32 trillion in 2016. A lot of this rise is due to the surge in refinance application, causing the MBA’s refinance forecast for 2016 to increase to $635 billion, up from its previous forecast of $415 billion.