With the financial crisis well behind the market, rising mortgage defaults and home prices are starting to simmer down.

David Blitzer, managing director and chairman of the Index Committee at S&P Dow Jones Indices, explained in the latest S&P/Case-Shiller report, that mortgage defaults are an important measure of the health of the housing market.

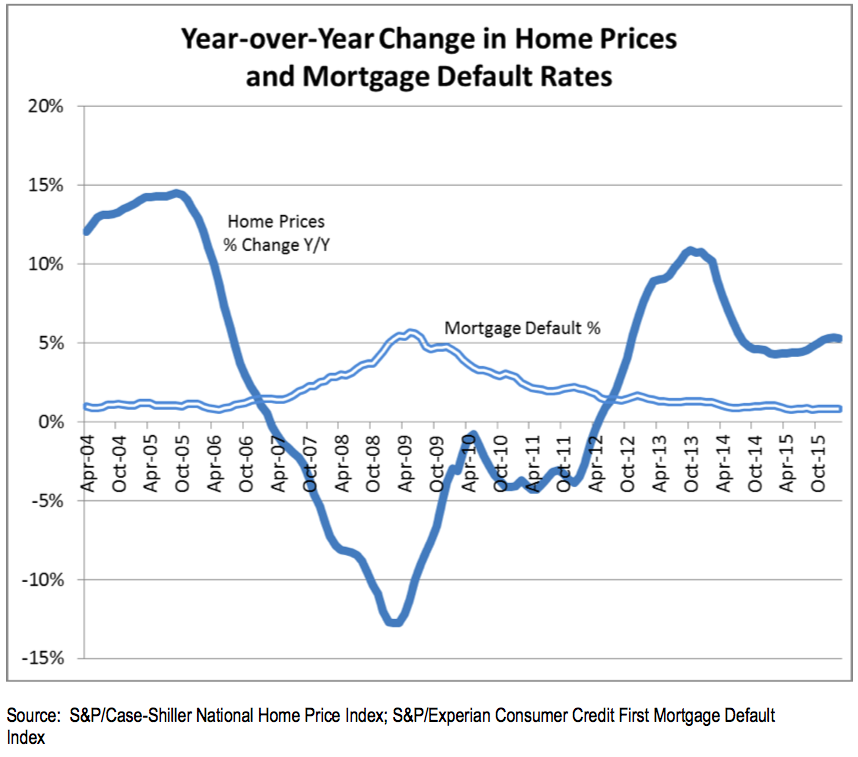

“Memories of the financial crisis are dominated by rising defaults as much as by falling home prices. Today as well, the mortgage default rate continues to mirror the path of home prices,” said Blitzer.

The chart below shows the correlation between the default rate and home prices.

Click chart to enlarge

(Source: S&P/Case-Shiller)

Blitzer said, “Currently, the default rate on first mortgages is about three-quarters of 1%, a touch lower than in 2004. Moreover, the figure has drifted down in the last two years. While financing is not an issue for homebuyers, rising prices are a concern in many parts of the country.”

The S&P/Case-Shiller report found that while home prices continue to rise, it’s at a slower pace.