Appraisal volume softened slightly for the week of Feb. 28 as the refinance market started to dwindle.

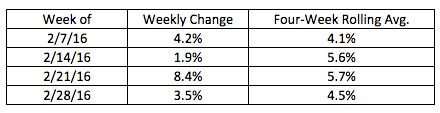

According to the latest report from a la mode, an appraisal forms software company that tracks appraisal volume throughout the country, the National Appraisal Volume increased 3.5% for the week of Feb. 28, compared to an 8.4% increase the prior week.

This report includes the four-week rolling average, which was slightly down, falling to 4.5% from 5.7% the previous week.

Click the chart to enlarge

(Source: a la mode)

Appraisal volume is an indicator of market strength and has some advantages over mortgage applications. Fallout is less for appraisals since they are ordered later in the mortgage process after credit worthiness is determined and there are few multiple-orders.

a la mode captures 50% of the appraiser market – more than 6 million appraisals per year since the fourth quarter of 2006.

“The slowing of the refinance market is tapering the appraisal order growth as we enter the spring home-buying season. The four-week rolling average is a more stable representation of trends that are less susceptible to weekly anomalies,” Kevin Golden, director of analytics with a la mode, said.

"It will be interesting to see how this year’s spring buying season unfolds. The prices have risen in many markets while credit remains tight and wages stagnant. The conflicting and unclear economic trends are leading to my wait-and-see attitude,” he added.

Last week’s mortgage applications report from the Mortgage Bankers Association said that the refinance share of mortgage activity plummeted to its lowest level since January 2016, making up 58.6% of total applications.

However, that doesn’t mean there isn’t plenty of potential demand left in the refinance market. Black Knight ran an example scenario where rates continue their downward trend. If the 30-year rate fell to 3.5%, 8.8 million people would benefit from refinancing. That is the largest number of refinanceable borrowers since 2012 to 2013, when rates were at their lowest.