Whereas household debt increased during the fourth quarter of 2015, repayment rates improved, according to the Federal Reserve Bank of New York’s Quarterly Report on Household Debt and Credit.

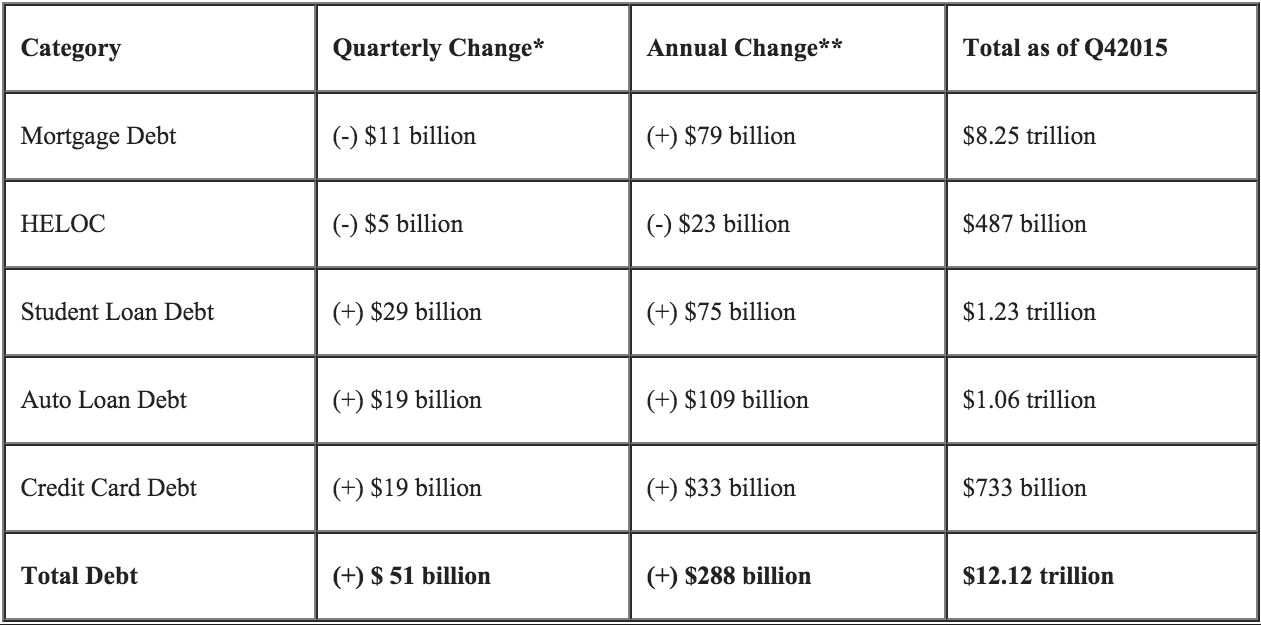

Total household indebtedness was $12.12 trillion after the $51 billion increase. Only 5.4% of outstanding debt was in some stage of delinquency. The rate was at its lowest since the second quarter of 2007.

Flat mortgage balanced are part of the reason for the modest aggregate debt growth. Following a trend that began more than four years ago, home equity lines of credit continued to decline. They fell $5 billion during the fourth quarter. About 56% of all new mortgage balances went to borrowers with credit scores above 760.

Unlike mortgages, auto borrowers’ originated from a varied group, with credit scores across the spectrum. Auto debt, which has steadily increased since mid-2011, increased by $19 billion. There were $132 billion of auto loan originations.

Driven largely by mortgages, overall delinquency rates improved last quarter. Only 2.2% of mortgage balances were over 90 days late. This was a slight increase from the third quarter’s 2.3%, and its lowest level since 2008.

“Non-housing debt balances have been rising, but the same cannot be said for mortgages,” said Andrew Haughwout, Senior Vice President at the New York Fed. “Mortgages are being paid down faster, helping to offset the generally rising volume of originations.”

Click to enlarge: