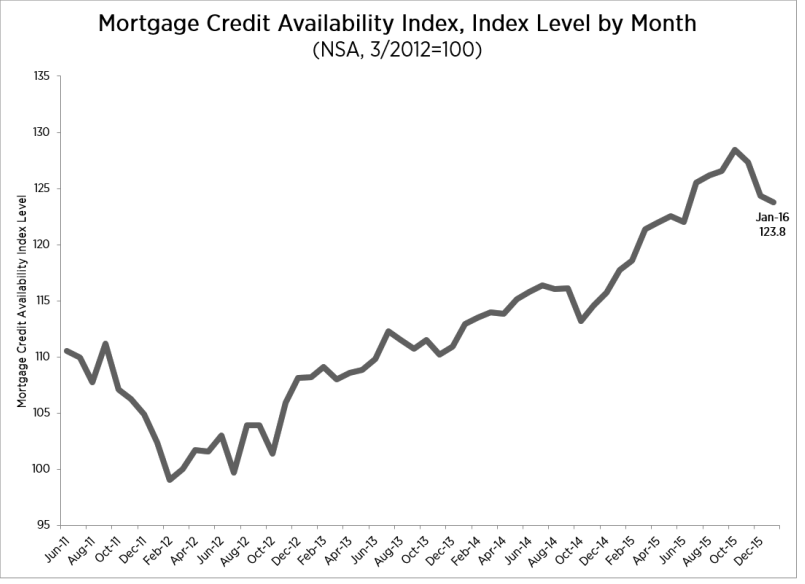

While small, mortgage credit availability fell in January, dropping 0.4% to 123.8, according to the Mortgage Credit Availability Index from the Mortgage Bankers Association.

The index analyzes data from Ellie Mae’s AllRegs Market Clarity business information tool. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012.

“Credit availability decreased over the month, driven by a decline in some FHA and conventional offerings as compared to the previous month. These declines in the MCAI were only partially offset by loosening among adjustable rate mortgage and jumbo lending programs,” said Lynn Fisher, MBA’s vice president of research and economics.

Click to enlarge

(Source: MBA)

Broken up into four component indices, the Conforming MCAI saw the greatest tightening (down 1.5%) over the month followed by the Government MCAI (down 0.8%).

On the other hand, the Conventional MCAI was unchanged, while the Jumbo MCAI increased 0.2% over the month.