Mortgage rates dropped even further below 4% for the third consecutive week as market turbulence drove investors to Treasuries, the latest results from Freddie Mac’s primary mortgage market survey said.

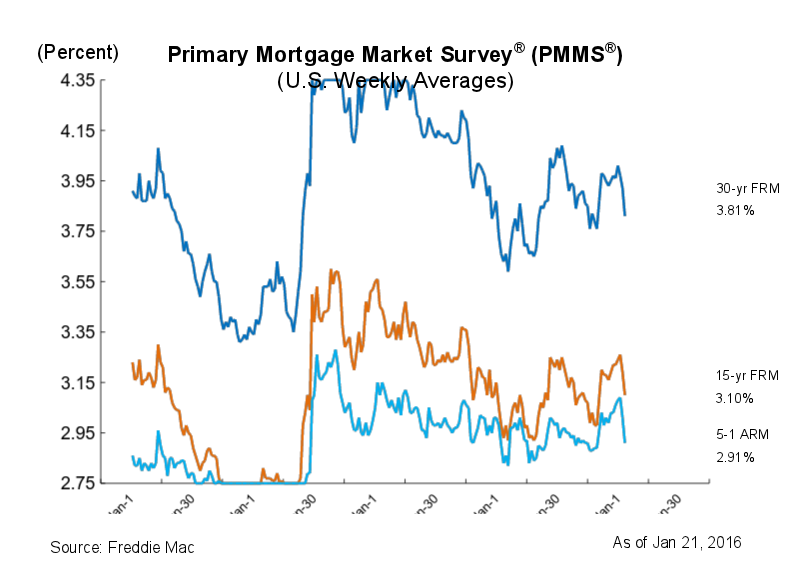

The 30-year fixed-rate mortgage fell to 3.81% for the week ending Jan. 21, down from last week when it averaged 3.92%. In 2015, the 30-year FRM averaged 3.63%.

Also falling, the 5-year FRM this week dropped to 3.1%, down from 3.19% last week. A year ago, the 15-year FRM averaged 2.93%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.91% this week, down from 3.01% a week ago. A year ago, the 5-year ARM averaged 2.83%.

Click to enlarge

(Source: Freddie Mac)

“The Freddie Mac mortgage rate survey had difficulty keeping up with market events this week. The 30-year mortgage rate dropped 11 basis points to 3.81 percent, the lowest rate in three months,” said Sean Becketti, chief economist with Freddie Mac.

On Wednesday, global stocks officially entered a bear market. According to an article in Business Insider, on Wednesday, “U.S. stocks started the day deep-red, and the sell-off has intensified through the trading day. Not long after noon, the Dow fell more than 500 points, and with the S&P 500 and Nasdaq, it declined by more than 3%.”

As a result, Becketti said the nonstop financial market turbulence drove investors to the safe haven of Treasuries.

However, he added that while the shaky market did impact rates, the survey was largely complete prior to Wednesday’s Treasury rally.