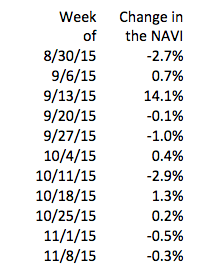

Appraisal volume once again moved slightly lower and fell 0.3% for the second week of November, the latest data from a la mode, inc., an appraisal forms software company that tracks appraisal volume throughout the country, said.

Last week, appraisal volume slipped 0.5% due to uncertainty regarding the economy.

Click to enlarge

(Source: a la mode)

“The national appraisal volume index was down 0.3% for the week of Nov. 8. With November historically the start of the holiday slowing and interest rates rising over the past week, the relatively slight decline is a good sign for the industry,” said Kevin Golden, director of analytics.

According to the latest results from Freddie Mac’s Primary Mortgage Market Survey, average fixed mortgage rates continued to trend higher amid market expectations of a possible rate increase by the Federal Reserve, with the 30-year fixed-rate mortgage averaging 3.98% for the week ending Nov. 12.

Golden added that there is a chance that the possibility of the Fed raising rates in December is enticing buyers to purchase sooner than later to avoid even higher rates.

In November, speaking before the House Financial Services Committee, Fed Chair Janet Yellen formalized the possibility of a rate hike in December, telling the Committee that December’s meeting is a “live possibility” for a rate increase.

Appraisal volume is an indicator of market strength and has some advantages over mortgage applications. Fallout is less for appraisals since they are ordered later in the mortgage process after credit worthiness has been approved and there are few multiple-orders.

a la mode captures 50% of the appraiser market – more than 6 million appraisals per year since the fourth quarter of 2006.