Under pressure from a tight credit and regulatory environment, companies in the mortgage space have responded by leveraging technology to gain more ground. In some cases this has meant adapting current systems to accommodate new processes, and in others, it has meant creating entirely new mortgage technology products.

In this section we highlight products that are game-changers for companies working hard to adhere to regulations while still providing great service to their clients. The list features products ranging from new mobile platforms to a loan-level audit capability that will reshape the way audits are done for years to come.

By tackling the challenges head-on, these companies are setting themselves up for long-term success. The efficiencies they see today will continue to pay dividends in the future as they realize significant gains from a faster, more streamlined process.

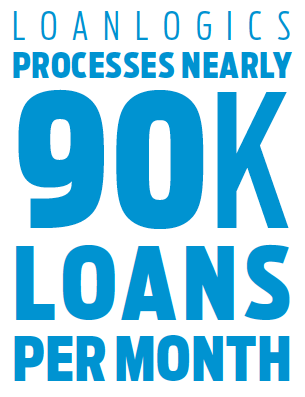

In today’s highly regulated mortgage industry, the cost of compliance has significantly impacted bottom-line profitability. In the midst of this environment, LoanLogics is committed to developing technologies that drive down the cost of compliance and improve loan quality, regardless of the risk profile of lending within the industry.

“Opening up the credit box, attracting first-time homebuyers and meeting profitability goals can be confidently achievable through sound quality oversight from pricing to payoff,” Allen Pollack, chief technology officer, said.

“LoanLogics, through the capabilities of our LoanHD platform, cost-effectively enable this oversight by applying automation and business intelligence to the evaluation of the people, processes and technologies used in mortgage loan production, sale or servicing,” Pollack said.

The company’s LoanHD Enterprise Loan Quality and Performance Analytics Platform helps clients validate compliance, improve profitability and manage risk during the manufacture, sale and servicing of loan assets.

“LoanLogics serves the needs of a diverse set of clients, including mortgage originators, investors, insurers and servicers, all of whom are concerned about loan quality and performance. Our platform is flexible enough to support modules specific to each of these market participants,” Craig Riddell, LoanLogics chief business officer, said.

The platform incorporates unique innovations to verify and validate loan file data from accurate pricing and eligibility, through the classification and data extraction of submitted loan documents, audit rules automation and structured audit workflows, to servicing on-boarding and loan performance analytics.

“Our platform delivers significant business value for our clients — minimizing defects and enabling consistent execution, repeatable outcomes and business intelligence for continuous process improvement — because it is designed specifically for loan quality and performance management,” Pollack said.

The LoanHD platform is an end-to-end solution using powerful analytics to find mistakes in data or documents and determine the root causes of errors. Trends and patterns can point toward areas for improvement and drilling down to granular data can drive specific actions, such as training, task elimination, further automation or outsourcing.

“Defects drive up operational costs, but these costs can be reduced when loan quality analytics reveal root-cause issues causing defects,” Pollack said. “Defects also impact top line results. In an environment that requires intense scrutiny of vendor partners, there are additional benefits of leveraging a robust and comprehensive technology solution through a single vendor. That is a gap the LoanHD platform has filled.”

The LoanHD platform technology capabilities, integrated with LoanLogics’ other services, enable clients to manage loan quality and compliance through an ecosystem of value.

As loans flow through production, technology-enabled quality checkpoints ensure every loan is reviewed in the same way, with loan documents indexed, data extracted and audit rules applied to find defects and minimize manual stare and compare procedures.

As loans flow through production, technology-enabled quality checkpoints ensure every loan is reviewed in the same way, with loan documents indexed, data extracted and audit rules applied to find defects and minimize manual stare and compare procedures.

Pre-closing to post-closing/pre-shipping/pre-funding audits and standardization of documents and data enable smooth sale of loans to investors or servicing on-boarding.

And finally, life-of-loan quality monitoring ensures confidence in the performance of the loan over time and provides analysis to pinpoint problem loans for proactive management.

“Our innovative technology is enabling the mortgage marketplace to optimize ROI related to compliance, quality and performance management, which are the keys for transforming lending from a high-cost production operation to a high-value link to homeownership,” Riddell said.

“We will continue to focus our efforts on increasing lending transparency, building regulatory and investor confidence and driving greater profitability throughout the industry.”