The upcoming reveal of the Federal Open Market Committee meeting minutes is expected to be underwhelming, contrary to the majority opinion, a report from Lindsey Piegza, chief economist with Stifel, said.

The FOMC met again on Tuesday and will release its meeting announcement at 2 p.m. on Wednesday, possibly giving more information about when interest rates will rise.

Piegza explained that this meeting is particularly importance as of late because the majority of economists anticipate that the Fed will begin to raise rates in September, or later this year, for the first time since 2006. Just this morning, for example, Jan Hatius, chief economist of Goldman Sachs [GS] reiterated that popular opinion. "Our forecast remains December, although September is possible if the data surprise clearly on the upside," Hatzius wrote in an email to clients.

However, Piegza argued that if the Fed did in fact intend to raise rates in September, the July statement would be noticeably Hawkish, opening the door for liftoff just seven weeks later.

Federal Reserve Chair Janet Yellen recently went on record again telling the House Financial Services Committee that the Fed will look at raising interest rates in 2015 if and as the labor market improves and inflation hits medium-range goals.

“If the economy evolves as we expect, economic conditions likely would make it appropriate at some point this year to raise the federal funds rate target, thereby beginning to normalize the stance of monetary policy,” Yellen said. “Indeed, most participants in June projected that an increase in the federal funds target range would likely become appropriate before year-end.”

But Piegza disagreed, saying, “The problem with this scenario, however, is that since June, the last FOMC meeting, the economic data has been relatively disappointing – so-so at best – giving the Fed very little to suggest, let alone justify, an increased assessment of economic activity.”

“As a result, contrary to the majority opinion, we expect the July statement to pass with little noticeable change in the language. In fact, we expect the July statement to be relatively unexciting – as unexciting as a Fed statement can be,” she continued.

Instead, Piegza said she expects a modest but positive tone in the upcoming July statement.

“We do not expect the Fed to raise rates in September nor do we expect the Fed to raise rates in December. We maintain our 2016 forecast for liftoff as we have for the past several years,” added Piegza.

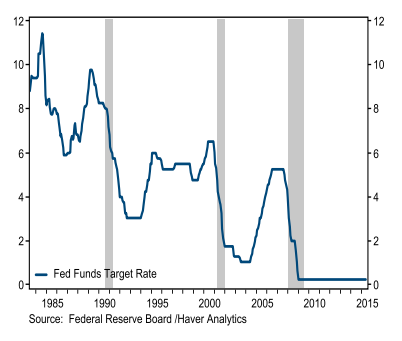

This chart shows how rates have progressed over the year.

Click to enlarge

(Source: Stifel)