While still struggling, the housing market is improving, with Freddie Mac’s latest housing report highlighting 5 metros that are outpacing the rest of the market.

As a nation, Freddie’s Multi Indicator Market Index sat at 75.4, indicating a weak housing market overall but showing an improvement of 0.69% from February to March.

The MiMi posted a three-month improvement of 1.24%, and on a yearly basis, the national MiMi value improved 3.11%.

To put this in perspective, the MiMi’s all-time high of 121.7 was in April 2006, with its low of 57.4 in October 2010 when the housing market was at its weakest. Since that time, the national MiMi value has made a 31.3 percent rebound.

"The nation's housing markets are getting back on track. Better employment prospects, rising home values and increased purchase activity are all driving improvements in housing markets across the country,” said Freddie Mac Deputy Chief Economist Len Kiefer.

“In this month's MiMi three more states and seven metro areas moved within range of their benchmark level of activity. However, as we've mentioned before, we're likely to see bouts of affordability shock with mortgage rate swings for the remainder of this year as market participants try to anticipate Fed timing around rising short term interest rates and expectations for global growth wax and wane," Kiefer added.

Here are the most improving metro areas month-over-month:

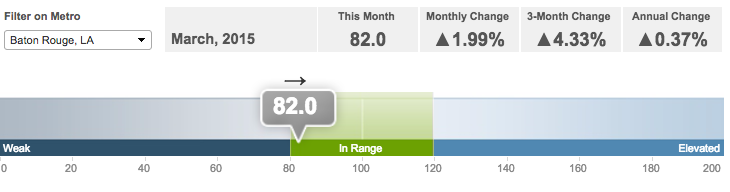

5. Baton Rouge (+1.99%)

Click to enlarge

Source: Freddie Mac

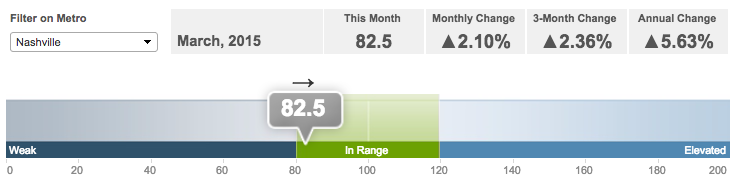

4. Nashville (+2.10%)

Click to enlarge

Source: Freddie Mac

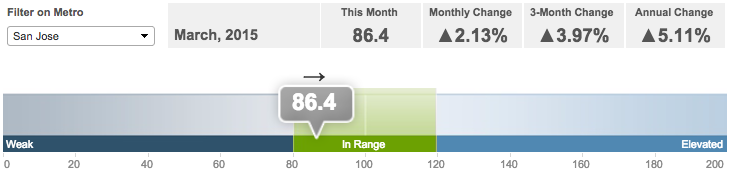

3. San Jose (+2.13%)

Click to enlarge

Source: Freddie Mac

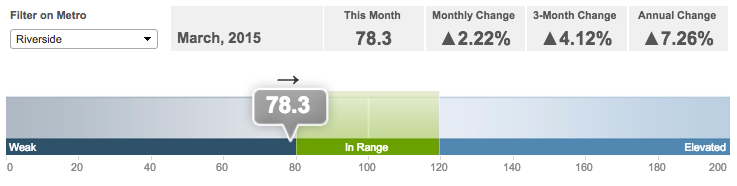

2. Riverside (+2.22%)

Click to enlarge

Source: Freddie Mac

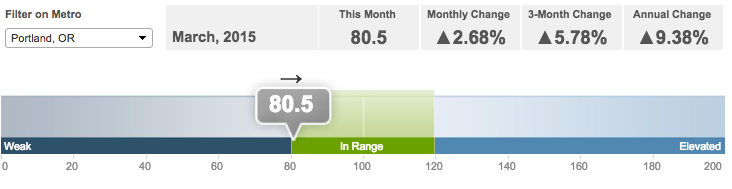

1. Portland (+2.68%)

Click to enlarge

Source: Freddie Mac