The future looks bright for private mortgage insurers this year, even as lower insurance premiums on FHA loans and stricter capital requirements from the Federal Housing Finance Agency add a level of uncertainty.

The private mortgage insurance industry has amassed a war chest of capital to deploy into the housing economy, and legacy PMIs that survived the housing crash are on more solid footing. Three new entrants into the market, meanwhile, are making their presence known.

The industry expects continued improvement this year although a Federal Housing Administration premium reduction coupled with stricter capital guidelines from the FHFA hit with a one-two punch.

Things weren’t looking so good as little as three years ago as a multiyear housing downturn took its toll.

“There was a time, we certainly believe, that the industry’s viability was probably questioned,” said Chris Curran, senior vice president, corporate development at Essent Guaranty Inc., a new entrant.

THE CRISIS

None of the PMIs that existed during the crisis emerged unscathed, and three national insurers — Republic Mortgage Insurance Co. (RMIC), PMI Mortgage Insurance Co. and Triad Guaranty Insurance — never recovered. All are in runoff mode and ceased writing new insurance in the years following the crisis because of insufficient capital to meet state regulator requirements.

The shaky financial condition of the PMIs during the housing bust brought to light counterparty risks and the need for stronger capital requirements.

Primary mortgage insurance provides lenders and mortgage finance giants Fannie Mae and Freddie Mac with first-loss protection on loans that exceed 80% loan-to-value. It reduces their potential losses in the event of default.

Once a borrower’s equity reaches a loan-to-value of 80%, he or she can cancel the private mortgage insurance. When the LTV hits 78%, lenders are required to automatically cancel it. This ability to cancel the policy is a big selling point for private mortgage insurers because it’s an option that is no longer available on FHA loans. If a mortgage is an FHA loan, then the insurance is provided by the government.

The nation’s steep rise in foreclosures caused significant losses for the MIs during the financial crisis and those losses had a domino effect on others in the housing sector — among them Fannie Mae and Freddie Mac — which took a financial hit when some MIs were unable to fully pay claims. FHA’s Mutual Mortgage Insurance Fund also suffered and is still undercapitalized.

ESTABLISHED INSURERS RECOVER

What a difference a few years make.

Legacy insurers are headed toward solid ground, with some experiencing their first full year of profitability since the housing crash. New entrants, meanwhile, are raising capital, entering the fray and gaining market share.

To be sure, legacy MIs have faced considerable headwinds since the 2008 financial crisis. In the years following the crisis, as a group, they paid out about $51 billion in claims.

Long-time industry player Radian Guaranty, which via its predecessor has been in business more than 40 years, achieved full-year profitability in 2014 for the first time since the 2008 financial crisis, said Teresa Bryce Bazemore, president of Philadelphia-based Radian.

“I think at this juncture we feel we are moving forward and past those legacy issues,” she said. “That doesn’t mean there aren’t still a larger number of defaulted loans than we would normally see, but when you look at how much of our portfolio now was written since the beginning of 2009, we can all agree it is some of the best business ever written.”

Bazemore said she feels good about where the industry sits today.

“I think the industry is in a much stronger place than it was,” she said. “Over time, as things get better and our portfolios improve and defaults go down, you sort of write your way out of these things. If you think of the private mortgage insurance industry, it was set up for this, as 50% of every premium dollar goes into a contingency reserve.”

That rainy-day fund built reserves to address a downturn, and this industry structure worked well through most downturns, but when the nation experienced the worst recession since the Great Depression, it took a toll.

The struggling MIs lost some credibility during this time due to high claim denials and rescissions. Investors complained that master policies lacked clarity and transparency about when insurers were allowed to deny a claim or rescind a policy.

But Rohit Gupta, president and CEO of Genworth, notes that even those three companies in runoff continue to pay off claims, with one now paying off at a 100% rate, one at 75% and the other at 67%. None of the three in runoff have required a government bailout.

Since the crisis, the industry also has provided more clarity for investors around contractual terms of their insurance policies. Working with the FHFA and the government-sponsored enterprises, all PMIs put new “master policies” in place last fall. These policies clarify the protections that private mortgage insurance provides.

Secondly, the industry will operate under more stringent capital requirements going forward. On April 17, the FHFA announced the new Private Mortgage Insurer Eligibility Requirements (PMIERS), which have an effective date of Dec. 31, 2015. The requirements include significant changes to the Minimum Required Asset factors.

“Those two things are really critical and important in giving people comfort around the ability to rely on the PMI industry on a go-forward business,” Bazemore said.

Like Radian, United Guaranty’s history is a long one — going back some 50 years. Inside Mortgage Finance ranks the Greensboro, North Carolina-based mortgage insurer No. 1 for traditional first-lien new insurance written, a position it has held for four consecutive years. For 2014, United Guaranty’s first-lien NIW was more than $42 billion. The company is a subsidiary of AIG.

United Guaranty completed 98% of full-file submissions within 24 hours during 2014, said Brian Gould, chief operating officer at United Guaranty. For lenders, full-file submissions reduce the chance of rescissions and buybacks. The company also began risk-based pricing on each individual loan in 2009.

United Guaranty completed 98% of full-file submissions within 24 hours during 2014, said Brian Gould, chief operating officer at United Guaranty. For lenders, full-file submissions reduce the chance of rescissions and buybacks. The company also began risk-based pricing on each individual loan in 2009.

The company holds the highest financial strength rating among the legacy insurers and more statutory capital than any other mortgage insurer, Gould said. Full-year earnings for 2014 were $592 million, up from just $9 million in 2012.

Gould said 23% of its business consists of pre-crisis policies — considered a riskier book of business due to looser underwriting during the run-up to the financial crisis. Still, the company feels good about how it is managing those older policies. “We’ve demonstrated to our customers, and to the market, that we are there even when times get tough,”

he said.

“There are many signs that the industry is stronger,” Gould said. “If you go back a couple years, there were capital raises from some legacy players. There have been some new entrants into the business. If you look at the recent financial results of the mortgage insurance companies, it shows that the industry is stronger. A strong mortgage insurance industry, we think, is good for all participants, especially borrowers.”

MGIC Investment Corp., based in Milwaukee, Wisconsin, is the parent company of Mortgage Guaranty Insurance Corp., which has been in business since 1957.

MGIC reported net income for the full year 2014 of $252 million, compared with a net loss of $50 million for 2013 — its first full-year of net income since 2006.

“Certainly, we are feeling great after our first year of profitability in a number of years,” said Margaret Crowley, vice president of marketing. MGIC expects business to modestly improve this year over 2014 as rates stay low and employment improves. It holds about a 19.8% market share.

New insurance written by MGIC in 2014 was up — $33.4 billion from $29.8 billion in 2013, while delinquencies were declining. Excluding bulk loans, delinquencies were 6.65% on Dec. 31, 2014, down from nearly 12% on Dec. 31, 2012.

“We are seeing our delinquency inventory shrink. Cures are improving. We are feeling good about the direction we are headed,” Crowley said.

Legacy insurer Genworth Mortgage Insurance Corp. of Richmond, Virginia, also is reporting stronger numbers — $91 million in net income last year — $125 million if you take out one-time charges. That’s up from $37 million in 2013.

This good news of growing profits comes after Genworth lost money in years 2008-2012, with its biggest loss being nearly $500 million in 2011, after taxes. It paid out about $6 billion in claims during those years.

Gupta said Genworth learned from the experience and made pricing and guideline adjustments beginning as early as 2008, long before the CFPB’s Qualified Mortgage rule was implemented. Delinquencies from its legacy book — pre-2009 — are declining at a rate of about 20% per year.

“We are exiting this cycle with a business that is stronger and well positioned to serve a strong role in the industry moving forward,” Gupta said.Genworth ended last year with a 15% market share, up from 13% in 2013.

“If you think about our business, we’ve gone through a significant turnaround,” Gupta said.

THE NEWCOMERS

Besides the four surviving legacy players, three newcomers are working hard to gain a foothold, and they come into the industry without the financial baggage of the housing crisis.

Newcomer Essent Guaranty Inc., based in Radnor, Pennsylvania, formed in 2008. It raised an initial $500 million in 2009 and wrote its first policies in May 2010.

“When Essent was formed, it was at the depths of the financial crisis. The investment thesis at the time was that there would ultimately be the need for more private capital to come into play to support housing through private mortgage insurance,” said Essent’s Chris Curran.

Curran said Essent gave lenders a new option, an insurer with none of the issues from the housing downturn.

“We were accepted quickly by the lending industry just because it gave them an opportunity to have mortgage insurance provided to their borrowers by a well-capitalized MI company with no legacy portfolio,” he said.

Since then, Essent has built its market share to almost 14%.

A year after Essent began issuing policies, National Mortgage Insurance entered the scene. Brad Shuster, chairman and CEO, and Jay Sherwood, president, began working on National MI’s business plan in 2011 and raised more than $500 million in startup capital the following year.

National MI, located in the San Francisco Bay area, issued its first policies in April 2013 and went public in November 2013. It wrapped up licensing requirements in all 50 states last year.

As one of the newest entrants, NMI only had a 4% market share as of the fourth quarter of 2014, but the company is bullish on its opportunities.

“Our next milestone is to become cash-flow positive, which we expect to happen later this year,” Sherwood said. “After that, we are continuing with our internal plans to become profitable, and a big piece of that will be continuing to expand our customer base and market share, which I’m very confident about.”

The company had 277 customers that generated NIW in 2014, Sherwood said. National MI is very focused on increasing share with the company’s existing customers, he added. “That’s probably where we see the majority of our growth coming from this year, but we will continue to work hard at signing up new customers as well.”

The newest entrant is Arch MI, a Walnut Creek, California, subsidiary of Arch Capital Group Ltd. Arch MI formed in January 2014 via the Arch Capital Group acquisition of CMG Mortgage Co. along with the mortgage platform of PMI Mortgage Insurance Co.

The newest entrant is Arch MI, a Walnut Creek, California, subsidiary of Arch Capital Group Ltd. Arch MI formed in January 2014 via the Arch Capital Group acquisition of CMG Mortgage Co. along with the mortgage platform of PMI Mortgage Insurance Co.

CMG had been a joint venture between CUNA Mutual Group and PMI Mortgage Insurance Co. and had insured only mortgages from credit unions.

Arch changed CMG’s name to Arch MI, recapitalized the company and expanded its mission to include private mortgage insurance on loans originated from banks and other market participants, as well as credit unions.

Arch MI’s parent company already had various insurance and re-insurance subsidiaries — mostly in the property and casualty lines. It viewed private mortgage insurance as an attractive opportunity.

The mortgage insurance business was originally set up a number of years ago to provide coverage on a re-insurance basis and to provide international PMI coverage. Arch has an Ireland-based subsidiary that writes PMI in Europe and offers re-insurance to PMIs around the world.

“We were concentrating on those other markets when CMG and PMI came up for sale,” said David Gansberg, CEO of Arch MI. “We saw this as an attractive opportunity to get into the U.S. mortgage insurance business.

“It would have been very difficult to start from scratch, but being able to buy a company — CMG — that had a good track record and a good book of business and the platform of PMI … was a good way to get into the business to complement things that were happening in other parts of our capital group,” Gansberg said.“We view ourselves as being in the best of both worlds —a new entrant and a legacy player.”

Even though CMG was a legacy company, it escaped many of the problems other insurers faced because loans generated from credit unions were generally of a higher quality and more conservative underwriting than those of the industry as a whole.

Back when 25:1 was considered an acceptable risk-to-capital for mortgage insurers, CMG never got above about 23:1 risk-to-capital compared to other legacy companies that were approaching 50:1 at their most troubled point, Gansberg said.

The legacy portfolio default rate from the acquired CMG portfolio is less than 3%, better than other legacy insurers, and the portfolio continues to develop positive earnings, he said.

The company wrote its first non-credit union private mortgage insurance policy in the spring of 2014. It continues to write mortgage insurance policies for credit unions and to have the largest market share of any PMI in this segment of the market.

“The challenge for us is to grow the bank business,” he said. Arch MI holds between 3% and 4% of the industry’s market share, which includes its credit union policies. It also just launched Arch Mortgage Guaranty Co. to seek opportunities in the portfolio and private-label market.

CHANGES AFLOAT

The revised PMIERs will require mortgage insurers to hold more capital and demonstrate that they’ll be able to pay claims. The initial disappointment with the revised PMIERS is that guaranty fees will be kept, for the most part, at current levels, rather than cut. Industry players had been hopeful that the FHFA would lower its guaranty fees in conjunction with the PMIERs release.

The final version also does not give credit for any future premium income, which is something the big insurers wanted.

Not all MIs have adequate capital to comply.

MGIC said in its Q4 webcast, for example, that it would fall $300 million short in required assets at the end of 2016 in meeting the capital requirements if the PMIERs were implemented as drafted. But the insurer said a combination of internal resources, additional or changes to re-insurance contracts and non-dilutive capital would enable MGIC to comply fully.

Genworth also doesn’t comply based on the draft PMIERs and will need a capital infusion of $500 million to $700 million, but believes it is well positioned to meet the standard with re-insurance and company cash, Gupta said.

Said NMI’s Sherwood: “I think once those are published there will be a number companies that will have to address that, but I expect they will be successful doing that.

“We really would like to have a strong industry to make sure that mortgage insurance continues to be a viable product in the marketplace,” he said. “The whole industry is pushing for the ability to provide deeper coverage for mortgage insurance.”

Finalization of the PMIERs should provide additional transparency in the marketplace on the financial strength of individual insurers.

The FHA premium reduction, meanwhile, took the industry by surprise, especially since the administration hasn’t yet shored up its MMI reserve fund. But most have downplayed the move and touted PMI’s benefits over FHA premium pricing.

“When we look at all 2014 business — even if we took into account the (FHA) premium reduction, most of the business we wrote in 2014, the borrowers would still have a price advantage (with PMI),” said MGIC’s Crowley. “We feel like it is not going to have a huge impact.”

LOOKING FORWARD

As a whole, the industry certainly appears to be on the mend.

“It is definitely on the upswing. I don’t know if I’d say on solid ground yet,” Arch MI’s Gansberg said.

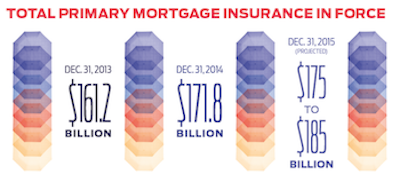

Total primary mortgage insurance in force was an industry-leading $171.8 billion as of Dec. 31, 2014, up from $161.2 billion as of Dec. 31, 2013. For 2015, the industry as a whole expects the industry to grow to between $175 billion and $185 billion this year, with historical lows for frequency of loss.

Competition has intensified with new pricing dynamics as legacy players try to protect their market share. Most expect added momentum in the industry this year despite continued challenges in the origination market. Industry players said they’ll push for a bigger role in housing finance, possibly expanding PMI coverage from about 25% of a claimable amount to about 40%.

“As we go into 2015, the industry and private mortgage insurance, in general, is very well positioned within housing finance,” Essent’s Curran said. “Private mortgage insurers have really been able to come back and play a bigger role with regard to supporting housing finance.”