When Rajesh Bhat, chief executive officer of technology startup Roostify, bought his first home, he remembers the process as an unpleasant experience — one he believes most people don't relish as they deal with dozens of players in the transaction and reams of complex documents.

“It’s an infrequent transaction and it’s viewed as something like a rectal exam that you have to go through and you don’t know what’s happening,” he said.

That unpleasant experience of getting a mortgage is beginning to move toward a more consumer-driven process as technology — now more than ever — holds the promise of bringing the mortgage process into the modern era.

“Technology has never played a more important role in the industry,” said Joe Tyrrell, senior vice president of corporate strategy at Ellie Mae, a loan origination system provider.

Two forces are simultaneously driving this change: 1) A tech savvy consumer who is conducting more and more financial transactions online; and 2) A new wave of costly regulatory oversight and compliance standards that make a digitized loan audit trail and the ability to process loans in an efficient and cost-effective manner more paramount than ever.

These two forces have pushed the lending sector forward significantly from some 15 years ago when there was much hype about the eMortgage. The eMortgage never came to fruition in any significant way not only because the technology wasn’t mature enough back then, but also because of the complexity of the mortgage process itself.

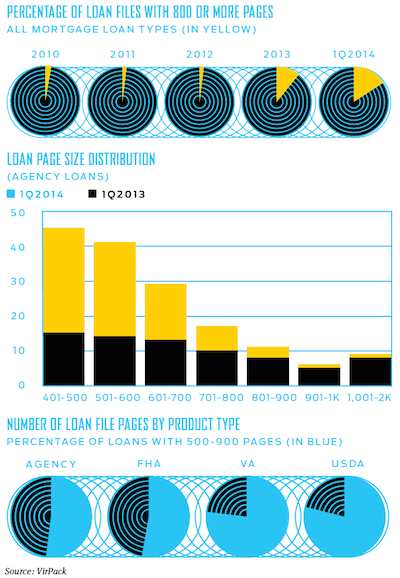

Buying a home is a complicated transaction. Just think of all that goes into it: The borrower looks for a lender or gets referred to one. Then there is the prequalification, the application and the required disclosures.That is followed by underwriting, processing, secondary marketing management and closing. There’s also the post-close loan management and transfers, loan servicing, default management, and loan disposition. The conventional loan file has increased in recent years to meet stricter compliance standards and now stands between 400 to 2,000 pages in length, according to VirPack, a provider of document management.

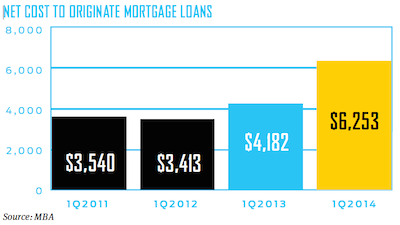

Total loan production cost per loan stands at a whopping $6,769, according to the Mortgage Bankers Association.

Why must it be so expensive, stressful, complicated and painstakingly slow?

MEET THE SINGLE STACK

The idea that the many complex steps that go into creating a mortgage can be automated, digitized and managed via cloud-based software is gaining significant momentum. This is the concept of the “single stack.”

In the tech world a “stack” refers to all the elements of something. For the mortgage industry, the idea of the single stack is that one platform (digital, automated and based in the cloud) can either meet all of the functional requirements involved in assembling a mortgage, or can serve as an efficient moderator for the process via open APIs (application programming interface), which are now taking off within the mortgage industry.

Companies are approaching the single stack from various angles. Several startups are intent on building a solution from the ground up with consumer sensibility. There are also established mortgage companies with long histories who are improving their existing technology and acquiring smaller players to build out their solutions. Major investment and venture capital firms are also in the mix, providing financial backing.

Mortgages have historically had specialist providers: One company does document imaging, another might do document storage, another would provide the LOS, and another would provide loan pricing, while still another would handle loan transfers to investors. Under the single-stack concept, these multiple providers potentially could still exist with systems that are built out with APIs. Or, the solution might come packaged as an end-to-end solution.

“There is a concept of vertical consolidation — you are a company, you have an LOS and now you are building or buying everything that can feed into the LOS — working toward that single stack,” Bhat said. However, Bhat believes that lenders don’t like the concept of a single technology company trying to own the entire stack.

THE STARTUP PHILOSOPHY

Startups see themselves as “disruptive” forces in the mortgage industry — out to change it and improve it — much in the way that Apple disrupted the computer and mobile phone industry or in the way Salesforce disrupted the customer relationship management market.

Roostify, based in the San Francisco Bay area, was founded less than three years ago by Bhat, who comes from an IT background. It launched its technology in January 2014. The company touts that its key leaders are technology gurus not mortgage professionals.

“The solution that we’ve designed and that we continue to evolve puts the consumer first,” he said. “The notion is by putting the consumer first, you are going to drive all sorts of efficiencies for everyone downstream — whether it is the loan officer or the processer or the underwriter or the Realtor or the title officer.”

Bhat said the technology allows consumers to create a very pristine mortgage application in a very quick time period, pulling in data from online sources. He touts that the technology is easy to deploy and LOS agnostic.

“I think the single stack from a lender’s perspective is ideally a seamless experience for every single party,” Bhat said. “They don’t need to necessarily be in the exact same system. For example, you could have Roostify as the entry place for the borrower but the lender continues to work in their LOS. The single stack is not technology in and of itself. It is more of an experience.”

New Jersey-based Blue Sage Solutions takes a similar philosophy to leverage open standards and APIs to allow lenders to plug in other proven high value functionality options, said Rob Strickland, senior vice president of sales and marketing at Blue Sage. “A lender looking to provide robust tools for their loan officers could plug in our CRM system or Web portals to their curent environment using Web services or other applicable integration options,” he said. “Our applications are designed to work seamlessly together but lenders can also leverage key modules independently as well. With this approach, lenders have the most flexibility assuring they are not held hostage to an inferior, inflexible solution stack.”

Blue Sage’s core team is comprised of experienced senior mortgage technology professionals previously with Palisades Technology Partners where they delivered the first completely web-based end-to-end origination platform serving five of the top10 lenders. Palisades was sold to IBM in 2006. Blue Sage was founded in 2011 and went live with its technology in 2013.

Its digital origination supply chain includes the core functionality to produce a loan: a website portal, a CRM, a LOS and mobile apps. The total solution provides about 80% of the functionality a company needs to produce a loan. It injects intelligence into its platform that allows lenders to write specific rules or to plug in their favorite vendor partners to complete the system.

Its digital origination supply chain includes the core functionality to produce a loan: a website portal, a CRM, a LOS and mobile apps. The total solution provides about 80% of the functionality a company needs to produce a loan. It injects intelligence into its platform that allows lenders to write specific rules or to plug in their favorite vendor partners to complete the system.

The automated process reduces costs and errors, and allows lenders to slice data in a granular way for compliance.

Blue Sage is going after the middle market — lenders making 1,000 to 5,000 loans per month.

“The mortgage — its time is now,” Strickland said. “People are requiring easier access to information so they can understand one of the biggest financial transactions of their life.”

Lenders need to understand what is available to them for a digitized, automated and cloud-based loan process and then evaluate who is the best partner to deliver it, he said.

San Francisco-based Blend Labs believes it has developed a solution that solves an important need in the market. Founded in 2012, the Silicon Valley tech company has created an operating system for mortgage originations and servicing. It rolled out its first set of marquee applications for loss mitigation and customer service in July 2014. Like other firms in the space, it uses open APIs to allow for lender customization. An audit tool that allows risk managers to identify the riskiest loans in their portfolios was rolled out at the beginning of this year. A mobile borrower experience app is expected to go live this summer.

“We are very bullish on our opportunity in the industry,” said Pranay Kapadia, vice president of product management, who joined Blend from Intuit where he was head of product for Mint.com, and prior to that Mobile Payments and QuickBooks.

“We don’t consider ourselves to be single stack, but we do want to be the platform that drives a real-time information exchange, from borrower to bond, that does not exist today,” Kapadia said. “We believe in connectivity with partners that is seamless.”

Blend Labs was started by veterans of Palantir Technologies, a deep Silicon Valley technology firm that empowers government and commercial customers to solve their hardest data challenges. In the wake of the mortgage crisis, Palantir worked with several large financial institutions and witnessed first-hand what happens when organizations have poor infrastructure to handle massive amounts of incoming data, Kapadia said.

In 2012, a core team left Palantir’s commercial group to form Blend Labs. The team knows big data and comes at the solution from a robust technology perspective, Kapadia said.

It has built out a workflow and process engine that can be rolled out and customized quickly. “One of our customers rolled out an application on our platform in two weeks and in the third week they had realized $1.6 million in loss-mitigation savings,” he said. The app allows a portfolio manager to test different loss-mitigation strategies with different pools of loans.

Some originators are still using desktop software that can take 12 to 24 months to update, and some servicers are tracking data in Excel and Sharepoint, a process that Kapadia calls “completely broken.” Further down the pipeline, when data goes from the servicer to the investor, it often travels by CSV files so investors are unable to see payments in real-time.

Blend Labs collects data in a way that allows a lender to drill down into details, Kapadia said. For example, its call center app allows the servicer to track every call and to note its duration, point of contact, as well as actions taken. Based on call duration and the total number of loans, the servicer is then able to determine requisite staffing in order to deliver customers the best service possible.

BRINGING EXPERIENCE

Not everyone making a run at the single stack is a startup. A number of well-established mortgage companies are in the mix.

Pleasanton, California-based Ellie Mae, an LOS provider known for its Encompass mortgage management system, has been around a long time.

“For us, everything starts with compliance,” said Ellie Mae’s Tyrrell. “The concern for lenders with buyback risk is really the place where they start every decision that they make. Compliance drives everything that lenders are evaluating.”

The company, through automation, is looking for ways to improve loan quality and add efficiency to the mortgage process. It plans to introduce consumer-direct and mobile applications this year.

“It’s not about the stack,” said Tim Anderson, director of e-services at DocMagic, a loan document preparation company that has been around for more than 25 years.

“What it is about is the consistency in how systems handle data. Our lenders are concerned about consistency in calculations. Consistency in interpretation of data. Having a single source of truth.”

Part of Ellie Mae’s strategy has been acquisitions to provide an end-to-end solution for the mortgage. It has acquired five companies in the past few years: Online Documents, a document service; Mavent, a compliance service; MBS, a product/pricing service; MortgageCEO, a CRM; and AllRegs, an investor/lender guidelines company.

Anderson believes the Consumer Financial Protection Bureau is driving much of the move toward technology adoption and acceptance in the mortgage sector.

“It’s not what they want (in technology) anymore,” he said. “It’s what they’ve got to do to be compliant.”

DocMagic has been participating in the CFPB’s eClosing pilot. The pilot will explore how the increased use of technology during the mortgage closing process could affect consumer understanding and engagement and save time and money for consumers, lenders, and other market participants.

DocMagic has been participating in the CFPB’s eClosing pilot. The pilot will explore how the increased use of technology during the mortgage closing process could affect consumer understanding and engagement and save time and money for consumers, lenders, and other market participants.

It’s important for the whole process to be electronic, not just the closing, Anderson said. Electronic audit evidence of who saw what, when and how will become very important from the beginning of the mortgage process to the delivery to the investor to be compliant with new regulatory requirements, he said. DocMagic uses a common enterprise system that updates data and documents simultaneously.

“Our documents are data driven, not image driven,” Anderson said. “The data we capture out of the lender’s LOS, dictate what the view — or output — looks like, whether it is electronic or paper that is just the view of the data.”

When a document is e-signed, it is wrapped with a tamper evident seal.

“When you paper-out, you lose control of the data, you lose control of the documents. You’ve lost data-document integrity when you paper out. If you start electronic and keep it electronic, you are going to have a much better experience for all parties.”

THE FUTURE

Unlike all the past hype of the e-mortgage, Ellie Mae’s Tyrrell believes technology today really will change how mortgages are done.

“Our industry has always been one of the last bastions of technology adoption, but with advent of so much regulation, it has really forced our industry to look for ways to adopt and embrace technology,” he said.

Companies in this space admit the competition is fierce.

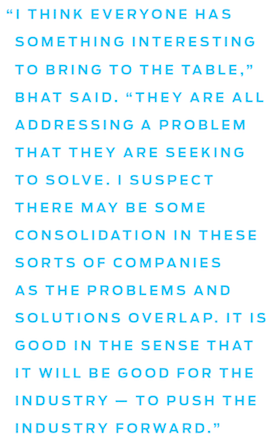

But that can be a good thing, says Roostify’s Bhat.

“I think everyone has something interesting to bring to the table,” he said. “They are all addressing a problem that they are seeking to solve. I suspect there may be some consolidation in these sorts of companies as the problems and solutions overlap. It is good in the sense that it will be good for the industry — to push the industry forward.”

BORROWERS DRIVE THE DIGITAL MORTGAGE EXPERIENCE

HousingWire sat down with Ghazale Johnston, a managing director with Accenture Credit Services, to discuss the complicated dance between what borrowers want and what lenders can offer when it comes to the digital mortgage experience.

HousingWire: How is new technology changing the mortgage market?

Ghazale Johnston:A new class of technology-savvy home loan borrowers is putting pressure on lenders to make the move to a more digital mortgage experience. Many of these consumers increasingly want to go online to rate shop, submit the application, have real-time access to loan status and upload and sign documents electronically. A recent Accenture survey of U.S. retail banking customers found that online sales of mortgages increased 75% from the previous year. Borrowers’ demand for convenience, easy access and transparency is forcing the mortgage industry to invest in better customer-facing digital tools.

HW: What are you hearing that lenders want in digital, automated and efficient cloud-based solutions to the mortgage origination process?

GJ: Lenders want an efficient workflow-driven approach that moves loans rapidly though the mortgage cycle, helping to save time and effort. Through the disaggregation of tasks, greater automation and improved quality control, lenders can achieve faster cycle times and a lower cost to serve. Automation can eliminate 15% to 25% of back-office data entry and other administrative tasks.

Additionally, more sophisticated use of customer data and analytics can help lenders predict customer behaviors and emotional drivers, enabling them to create a set of personalized recommendations and services tailored to unique borrower segments such as first-time home buyers.

Lenders also want to play an expanded role in the home buying process. To do so, lenders must leverage digital technology to engage with customers even before they apply for a mortgage. Accenture research found that more than half of customers want their bank to proactively recommend products and services for their financial needs. More than 40% of retail bank customers are interested in having their bank recommend local Realtors and homes that fit their needs, in addition to getting a mortgage, according to our research.

HW: Where does Accenture fit into the single stack mortgage: the idea that one platform can either meet all of the functional requirements involved in assembling a mortgage, or can serve as an efficient moderator for the process via open APIs, which are now taking off within the mortgage industry?

GJ: The goal should be a simplified application architecture with a single LOS. Some lenders still have to access as many as 15-20 different systems from application through closing. This slows down the process, creates data integrity issues and results in a poor user experience.

While a single platform can enable a more efficient end-to-end process, technology alone is not a silver bullet. Highly trained staff and first-rate processes are also vital. These are among the many capabilities Accenture has assembled to achieve its goal of having the industry’s most efficient mortgage manufacturing operation. For example, we have applied lean manufacturing principles to drive efficiency and consistency across the process. We have also built the Accenture Credit Services Mortgage Academy in the U.S. and India to grow our own talent and teach the “Accenture Way” to process mortgages. Our investment in SAFE ACT licensing for our delivery center in India has also broadened our ability to help our U.S. operation “get today’s work done today” and maintain compliance.