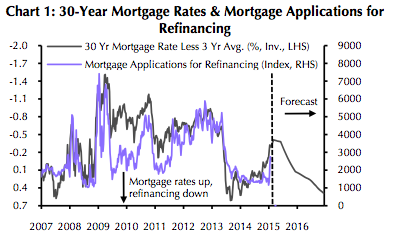

Mortgage rates have remained significantly below 4% for some time now and are forecasted to trigger a refinancing boom that will last the first half of 2015, according to a Capital Economics report.

“Judging by the past relationship between rates and refinancing, our rate forecasts suggest that refinancing applications could rise by a total of 230% within a month or two, and sustain that level until the middle of the year,” the report said.

Click to enlarge

Source: Capital Economics

The latest Freddie Mac Primary Mortgage Market Survey recorded the 30-year, fixed-rate mortgage averaging 3.66%, and the 15-year, FRM averaging 2.98%.

“Mortgage interest rates probably have a little further to fall, and when they start rising later this year they will do so very gradually,” the report added.

However, the report included three reasons why the impact of the next refinancing will be more muted:

- The historical relationship with interest rates suggests that during this refinancing round the number of borrowers refinancing will be about half the number who did so during the 2012 boom.

- The savings made by refinancers this time around will be fairly small, as rates have been low for an extended period.

- Incidences of payment stress are much lower now than they were during previous rounds of refinancing and very close to long-run norms. That means that lower mortgage payments won’t have the same impact on lowering mortgage delinquency and foreclosure rates.

Jason Dickson, branch manager of the Texas Region, Churchill Mortgage, said in a previous article that rates are low enough again and enough time has passed to give people incentive to refinances.

Dickson explained that there are thousands of homeowners who did not take advantage of the low rates back then, and now have the ability to do so, listing four reasons that can be found here.