Last week I wrote about my four predictions for housing, now I write about a market that hits a little closer to home.

The Dallas-Fort Worth region will be one of the top real estate markets in the country in 2015, according to forecasts from industry insiders.

As a mortgage provider serving the area (among others), we are keeping a close watch on the market, and here's what we've learned about what to expect.

For the second year in a row, Dallas-Fort Worth ranked as the fifth best area in which to build or invest in real estate, according to the “Emerging Trends in Real Estate” report from the Urban Land Institute and PricewaterhouseCoopers.

The region’s strong economy and its potential for growth and expansion get the credit for the strength of the DFW housing market. The region has become a hot bed for attracting businesses that bring jobs and spur housing demand. To date this year, Texas has gained the most jobs of any state, 421,900, according to the Bureau of Labor Statistics. Among the 12 largest metro areas, the Dallas-Fort Worth-Arlington MSA ranks second for the rate of job growth and third for the number of jobs added.

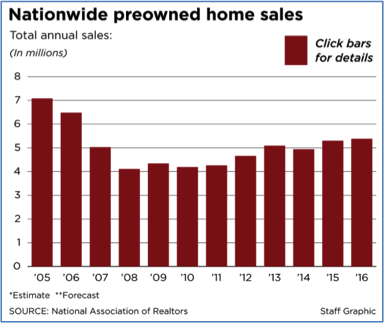

Comparing the Numbers

Click to enlarge

Source: Guardian Mortgage

When comparing the numbers of the Dallas housing market against some of the nation’s other movers and shakers, it’s easy to see how forecasters expect good things from the area in 2015.

Prices of DFW preowned homes were up 7.4% in September, higher than the national increase of 4.9%, compared to a year ago, according to the Standard & Poors/Case-Shiller Home Price Index. The report also shows that DFW home prices are now 12% higher than they were before the recession. A new CoreLogic (CLGX) report, meanwhile, shows Dallas home prices up by 9.1% in October from a year earlier, second only to Houston.

As of November 2014, the median average sales price for a preowned home in North Texas clocked in at 6% higher than in the first 10 months of 2013.

2015 Expectations

Though growth is expected next year, the housing market still faces significant headwinds. First-time homebuyers haven’t returned in significant numbers, and mortgage rates and prices are expected to creep upward, potentially dampening demand.

Mortgage rates still remain extremely affordable, and predicted increases could entice fence-sitters to buy before they rise any more. Current 30-year home financing costs are running at about 4%. A 1 percentage point rise in mortgage rates would add close to $100 a month to the payments for an average preowned home in North Texas.

The days of double-digit home value appreciation will subside as more preowned home inventory becomes available, allowing the market to create a natural balance between homebuyers and sellers. This balance likely will create a slower list-to-close process.