Heading into the fourth quarter, mortgage lenders are looking to finish the year on a high note after facing the challenges of decreasing purchase volume and increasing production expenses. In this landscape, technology that can save lenders time and money is a valuable commodity.

Here are three ways that mortgage lenders can leverage mobile imaging to increase their profits and speed time to closing:

1. Get it right the first time.

Compliance costs money. The Dodd-Frank reforms alone introduced about 250 new standards that financial institutions have to comply with, and many of those standards are tied to the accuracy of borrower information — data from their bank accounts, pay stubs, and tax forms, for example.

This vital information is the foundation of loan underwriting, and mistakes here can cost lenders on the front end if they reject loans that should qualify, or on the back end when loans are found to be out of compliance. As stated in a recent Forbes article, “It is here, at the beginning of the approval process, where the deal is made or broken.”

Mobile apps can improve the accuracy and timeliness at the start of the mortgage application by letting borrowers use smartphones and tablets to snap pictures of their supporting documents (typically in analog format). The app then extracts the data, validates it and converts it into the lender’s system of record. Advanced image perfection means lenders get error-free data in the crucial first steps of the mortgage process and all extracted data can be visualized and audited for reporting and compliance purposes.

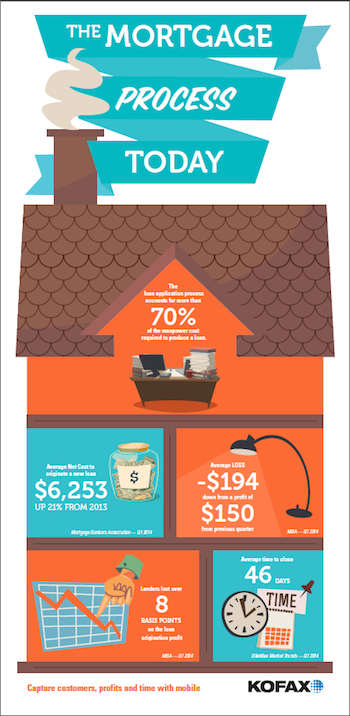

(Click graphic to enlarge.)

2. Reduce security risks.

Data security is more important than ever, for both consumers and lenders. Automating the process of sending, receiving, or inputting borrower data reduces the chances of data breaches — whether unintended or malicious.

A process where borrower information has to be manually entered into a lender’s system is fraught with potential security problems. By using a mobile data capture solution, sensitive information can be automatically extracted and integrated into a lender’s loan origination system without the manual process step. Lenders can increase borrower data security while improving their time to closing.

A 2014 study by cybersecurity firm Halock found that 70% of the mortgage lenders they surveyed allowed borrowers to send sensitive personal information over unencrypted email. The reason? Customers wanted something easy to use, and mortgage lenders wanted to accommodate them. As bankrate.com elaborated, “Lenders are reluctant to inconvenience customers with security measures.”

By using mobile digital imaging, lenders get to provide a secure upload for borrower data, through devices customers are already comfortable using.

3. Reach more borrowers.

Borrowers want the mortgage application process to be easy and fast. As a 2014 Forrester study found: “Consumers reserve meals, cabs, and flights; share music; make videos; and even screen potential mates on their phones. Whatever product or service you offer, your customers expect you to deliver mobile utility.”

This is especially true for younger buyers, who check their smartphones an average of 43 times a day, according to Stephen Ostermiller of SavvyRoo. By engaging them on their preferred mobile devices, you can attract more borrowers and increase customer satisfaction. Mobile app technology makes it simple for borrowers to participate in the lending process, using this self-service model.

In a mortgage market that is increasingly squeezed by rising costs and increasing compliance burdens, a mobile solution can be a game-changer for lenders. Making the process easy and convenient attracts more buyers, while reducing costs and risks for lenders.

To find out more about capturing customers, profits and time, click here.