Another massive portfolio of subprime vintage non-agency debt hit the market on Wednesday, with investors gobbling up nearly all of the $1 billion in pre-bust bonds.

According to bond analytics firm Interactive Data, a $998 million package of legacy debt from 2006 and 2007 came to market on Wednesday morning with nearly all of the bonds trading hands.

Per Interactive Data, $885 million of the $998 million in available debt was subprime. The remaining debt was made up of $73 million in bonds backed Alt-A fixed-rate mortgages and $40 million in Alt-A adjustable-rate mortgages.

Of the 13 available bonds, only one, BSABS 2007-HE2 23A from Bear Stearns, did not trade.

The remaining 12 available lines of debt included bonds originated by Citgroup Mortgage, CMLTI 2007-AR7 A2A; Countrywide, CWL 2007-7 1A, CWALT 2006-22R 1A10 and CWALT 2006-14CB A1; Morgan Stanley, MSAC 2006-N C4 A1; and others.

“It looks like a decent execution,” said David Varano of Interactive Data. “Nothing covered below low end, but several traded at the upper end.”

Interactive Data also said that all but two of the bonds bid for the entire current face value of the respective tranche, "signaling that a GSE is the likely seller of these legacy bonds."

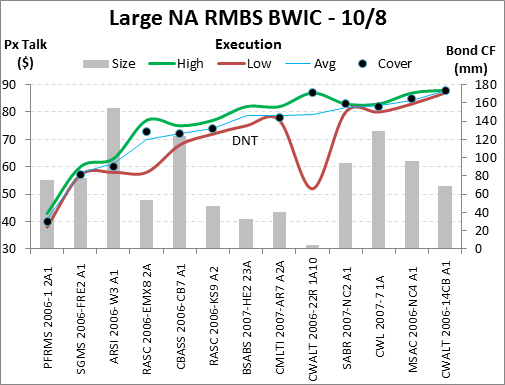

Click the image below to see Interactive Data’s breakdown on the size and pricing of the bonds traded Wednesday.

Also among the bonds that traded Wednesday were:

People's Choice Home Loan PFRMS 2006-1 2A1

Société Générale SGMS 2006-FRE2 A1

Argent Securities ARSI 2006-W3 A1

Residential Asset Securities Corporation RASC 2006-EMX8 2A and RASC 2006-KS9 A2

Credit-Based Asset Servicing and Securitization CBASS 2006-CB7 A1

Securitized Asset Backed Receivables LLC Trust SABR 2007N C2 A1

The trade was the latest in a trend that has seen an increase in subprime debt trading in the last several months. The subprime market was all but dead from January until July. Since then, several large packages of subprime bonds have traded.

In August, $366.14 million in subprime bonds traded. That list featured some of the most notorious names in subprime lending, including: Ameriquest Mortgage, Countrywide Financial, Bear Stearns, Goldman Sachs, JPMorgan, and Citigroup.

In July, two separate bond deals from BlackRock roused a market that had been slumbering since January, when the Dutch State Treasury Agency liquidated the last $4.3 billion residential mortgage-backed securitization remaining from the ING US portfolio.

The January 16 sale of the ING portfolio was the largest single day of non-agency RMBS selling activity prior to the BlackRock sale of $3.7 billion in debt on July 15, according to Interactive Data.

The following week, Credit Suisse won two separate bids for a combined $4.4 billion pool of legacy RMBS, also sold by BlackRock.

And at the end of July, an undisclosed seller brought $640 million in non-agency subprime debt to the market.

And last month, $477.8 million in non-agency pre-bust bonds traded as part of $727.3 million package.