There’s a new name in the REO-to-rental securitization market. Progress Residential is set to bring a $473.4 million to market soon. The offering is backed by a single loan secured by a first priority of mortgages on 3,142 income-producing single-family rental properties.

The offering, Progress Residential 2014-SFR1, is the latest in what has become a booming rental securitization market.

In August, another company, American Residential Properties (ARPI), also launched its first REO-to-rental securitization. The $342.67 million offering was backed by 2,880 single-family rental homes.

Several weeks before that, Silver Bay Realty launched its first securitization, a $312.67 million offering, supported by 3,089 single-family homes.

And in late July, Invitation Homes brought its third REO-to-rental securitization to market. The offering, Invitation Homes 2014-SFR2, was collateralized by a single $720 million loan secured by the mortgages of 3,750 single-family rental properties.

Now, Progress Residential is joining the party, with its first offering.

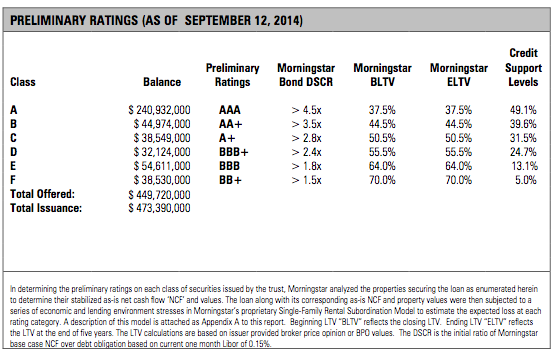

Morningstar and Kroll Bond Rating Agency have each weighed in on the securitization with presale reports and awarded nearly $241 million in AAA ratings to the securitization’s Class A tranche.

Click the image below to see Morningstar’s ratings.

Morningstar noted the lack of vacancies in the pool as a positive. “There are no upfront vacancies or delinquencies in the current pool,” Morningstar said in its presale report. “Also, there are no assumed tenants and none of the tenants are on a month-to-month lease. All of these are strong credit attributes that contribute towards a stable stream of cash flows to the trust.”

Kroll noted that its ratings methodology assumes “some level of natural vacancy” for all rental securitizations, regardless of their level of vacancy at the time of securitization.

As with all of the previous single-family rental securitizations, both Kroll and Morningstar cautioned that the asset class is still relatively new and that the business model is still evolving.

Morningstar also noted that the average rehab cost of the properties was $12,661, which it said is “substantially lower” than most issuers. “However, the total cost basis is higher at an average of $180,957,” Morningstar said. “This is on the higher end of the range when compared to recent single-family rental transactions.”

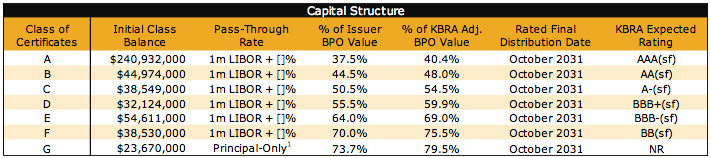

According to Kroll’s report, Progress 2014-SFR1 will be the sixth of the ten total single-family rental securitizations to be structured with an interest-only loan.

Click the image below to see Kroll’s presale ratings.

“Similar to those six transactions, Progress 2014-SFR1 has a fully extended loan term of five years,” Kroll noted. “All else equal, IO loans are riskier than amortizing loans, which provide for natural deleveraging over the loan term that results in lower risk of maturity default. In addition, should the loan default later in its term, it will experience a higher loss given default relative to an amortizing loan owing to its higher principal balance.”

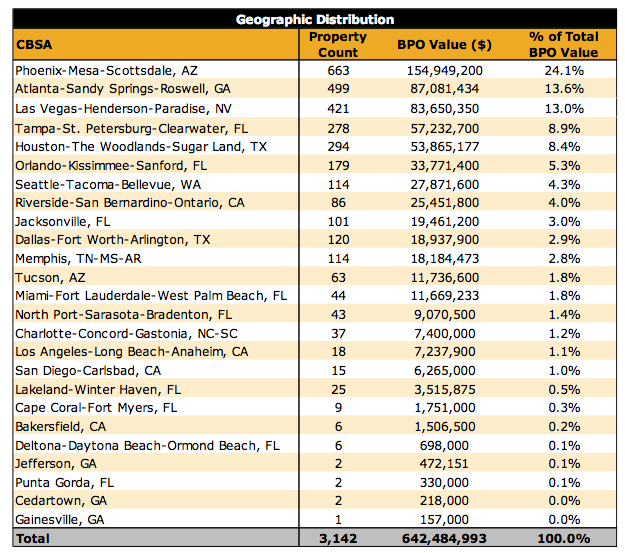

Nearly one quarter (24.1%) of the underlying properties are located in the Phoenix-Mesa-Scottsdale, Arizona metro area. The Atlanta-Sandy Springs-Roswell, Georgia metro area makes up 13.6% of the pool and Las Vegas-Henderson-Paradise, Nevada makes up 13%.

“The properties in the subject transaction have the second-highest geographic diversity by state among all of the prior SFR securitizations,” Kroll said in its report.

“The homes are located in 10 states, with the top three representing 61.0% of the pool. This compares favorably with the eight prior SFR transactions, which had underlying collateral properties in five to 11 states, and top three state concentrations ranging from 48.5% to 89.0%, with an average of 73.7%.”

Click the image below for geographic breakdown of the offering.

Progress Residential is a fairly young company, founded in September 2012. As of Sept. 1, Progress had invested approximately $1.8 billion in its portfolio of 10,300 homes, with approximately 700 more under contract to be acquired, Kroll said in its report.

Morningstar said Progress’ level of investment makes it one of the four largest operators in the industry.

“The company has a limited track record of operating in the SFR sector, however, KBRA believes Progress has the experience and has demonstrated that the company has adequate controls in place to ensure that payments are processed in a timely manner and that properties are maintained to high standards,” Kroll noted in its presale.

“The company has experienced rapid growth and has acquired a significant number of homes over a short period of time,” Kroll’s report continued. “This, combined with Progress’ long-term plan to internalize property management functions, (means that) it is uncertain how successful the company will be in managing its growing operations over a long period of time.”