The monetary appeal of flipping a home is starting to dissipate as the market returns to historical trends. Back in the second quarter of 2013, 6.2% of homes were flipped, compared to just 4.6% in the second quarter of 2014, according to that newest Residential Property Flipping Report from RealtyTrac.

This is also down from 5.9% in the first quarter of 2014. But when looking at home price trends, it comes as no surprise.

According to Trulia’s home price report, for the first time in more than two years, none of the 100 largest U.S. metros had a year-over-year price increase above 15% as home price increases start to decrease in pace.

“Home flipping is settling back into a more historically normal pattern after a flurry of flipping during the recent run-up in home prices in 2012 and 2013,” said Daren Blomquist, vice president at RealtyTrac.

“Flippers no longer have the luxury of 20 to 30 percent annual price gains to pad their profits. As the market softens, successful flippers will need to focus on finding properties that they can buy at a discount and efficiently add value to,” Blomquist added.

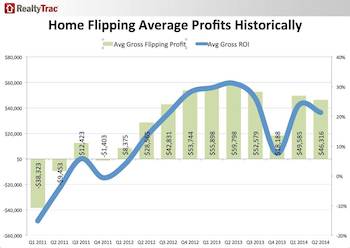

On average, investors made a gross profit of more than $46,000 per flip on homes flipped in the second quarter of 2014, a 21% gross return on the initial investment.

This is a drop from 24% in the first quarter and down from 31% in 2013, which was the peak in percentage return on flips nationwide since RealtyTrac began tracking the flipping data in the first quarter of 2011.

(source RealtyTrac: click for larger image)

And the problem is not only with increasing home prices, with CoreLogic reporting that the foreclosure inventory across the nation continues to shrink.

While this is good news, it means less distressed properties to buy and flip.

This does not mean the days of home flipping are over though. Zillow (Z) has listed the top 10 markets where it pays the most to become the Ropers.

These are the best places where the amount an owner can charge a tenant is greater than mortgage costs.

As a whole for the month of May, there were 47,000 completed foreclosures nationally, a drop from 52,000 in 2013, a year-over-year decrease of 9.4%.

At the top were Oklahoma City, Miami, and Tulsa, where homeowners can make an average of $536, $515, and $396, respectively.