There is a lot going on right now in housing and mortgage markets. But one of the debates that continues to rage on is whether U.S. housing markets are in a bubble or not.

HousingWire's own monthly HW Magazine talked about it in detail in our January issue.

So too has CNBC's John Carney, in a post from late last year with the headline: Yep, it's another housing bubble. And then on January 14 of this year, Peter Wallison at the American Enterprise Institute wrote a breathless op-ed proclaiming: The bubble is back.

But is it really a bubble just because home prices are rising again?

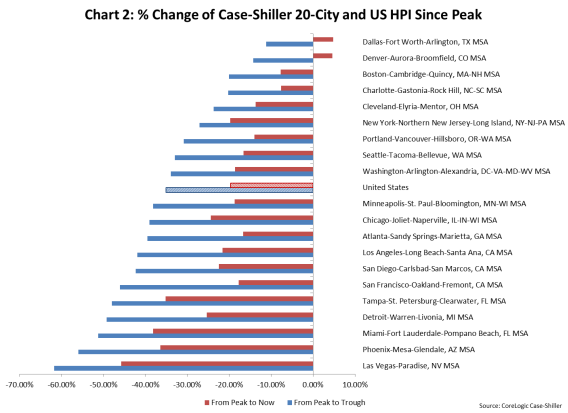

They say a picture is worth a thousand words, and this chart published today by rating agency DBRS in their annual overview of the RMBS market for 2014 suggests that anyone claiming a new housing bubble is simply ignoring the most basic housing fundamental of them all: nominal home prices.

Here's a reality check for the bubble watchers out there:

(Click the image for a larger view)

Most markets haven't yet reached their pricing level highs from the previous cycle, with the exception of two markets that saw the least amount of decline.

Those who want us to think there is a bubble cite the relationship between home prices and rental rates; or look at some calculated measure of affordability. And when those are out of whack, they say it's a bubble.

But it could be that rental rates are themselves out of whack, not housing prices. And it could be that other variables are affecting affordability rather than just prices, too. Supply and demand factors can do funny things to ratios, all of which need to be read in context.

No analysis should ignore market fundamentals, should it? Can we really be building another housing bubble if home prices in almost every U.S. market right now haven't even surpassed levels they once were at — even after the strong price rebound we've already seen in the previous year?

After five years of a housing economy that has been either horrible or just plain bad, it's difficult to believe that one good year somehow suddenly puts the nation's housing markets back into the bubble.