Market participants are fully aware of the beating refinance volumes are currently taking as the majority of mega banks continue to cut jobs by the thousands.

For those who believe the drop in refi volumes is all but a small small bump in the road on the way through a housing recovery, you’ve got another thing coming.

Economists at the Mortgage Bankers Association last week popped that bubble after announcing their predictions for refis to drop to $463 million in 2014.

Purchase originations are expected to rise from only $661 billion to $723 billion, according to MBA data.

If we take into account another two years, originations will modestly grow to $796 million in 2015 — that’s half of what they were during the housing heyday.

Everyone knows that the more originations in coming up years means more options for mortgage fraud risk. But how much will actually take place?

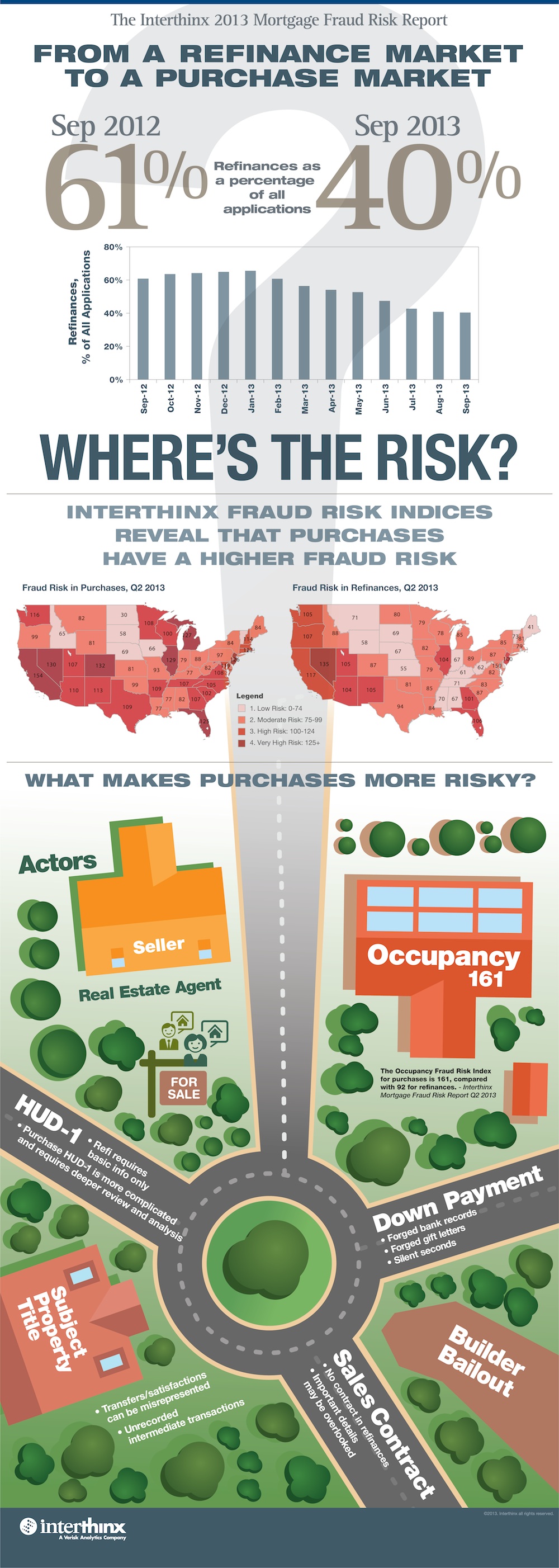

Interthinx created a specialized info graphic (feature below) for HousingWire to answer this very question.

The company revealed that purchases have a higher risk of fraud, with California, Florida and Illinois leading the way as the riskiest states.

What is it that makes purchases so much more risky?

Purchases are more complicated and required deeper review and analysis while refinances only require basic information.

Additionally, transfers and satisfactions can be misrepresented by unrecorded intermediate transactions.

The bottom line: As the refi boom finally takes it final curtain call and originations take over, the market is dealing with riskier products — leading to a greater likelihood of mortgage fraud.