The recent jump in housing starts was mainly driven by a surge in multifamily construction. At least that’s what the latest U.S. Residential Mortgage Market Update by Deloitte is claiming.

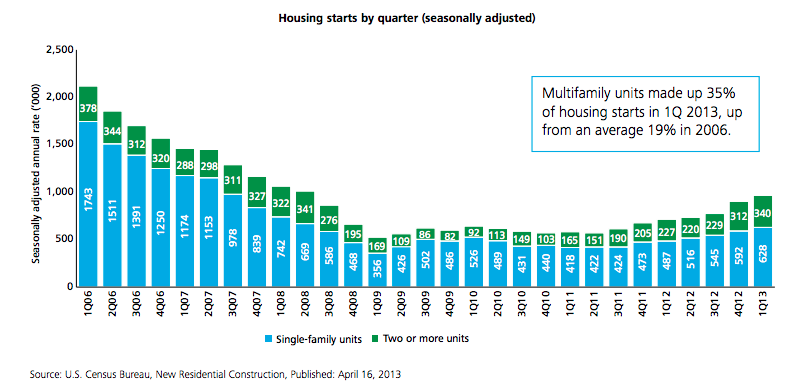

Tight housing supply in recent months has caused builders to respond by pushing housing starts in the first quarter above the one million mark for the first time since June 2008. Total housing starts rose 35% year-over-year in the first quarter, with multifamily starts up 9.1% to an annual rate of 340,000 units.

In April of this year, housing starts slowed their pace, likely as a result of inclement weather. However, permits rose indicating more construction later in the second quarter.

According to the Deloitte report, as new supply begins to hit the market, particularly in the multifamily sector, it may put downward pressure on housing prices.

In the first quarter of this year, multifamily units comprised 35% of housing starts, up from an average 19% in 2006.

“What we’re starting to see now is that construction costs are starting to really hit apartment builders even though there’s a lot of demand,” said Brendan Coleman, senior vice president of multifamily finance at Walker & Dunlop.

The cost for workers and materials is rising significantly from where it was three or four years ago, and the pricing power that builders have is waning a little bit, said Coleman. “Workers know they can charge more,” he added.

Morris noted that an estimated 200,000 new units will be built in 2013, although demand is probably closer to 400,000 new units.

“What we’re seeing is a lot of uncertainty in the multifamily market,” Coleman said.

Loans are getting much more expensive because of interest rates and there is much uncertainty around Fannie Mae and Freddie Mac, he said.

But Coleman feels confident supply will eventually catch up with demand. “It’s such a cyclical business,” he said.

Coleman noted that if the government does something significant to Fannie Mae and Freddie Mac regarding single-family finance, it will be harder for people to qualify for single-family homes and might push multifamily demand even further.