The nation's foreclosure landscape is changing rapidly.

While it looks like foreclosure activity continued to boil over in a select group of markets in July, Arizona slid out of its top 10 highest foreclosure rate slot for the first time since the zenith of the housing boom.

The amount of foreclosure filings in Arizona fell 15.8% in July and is also down nearly 50% from year ago levels. The state is now in the ranks with California’s foreclosure rate, which was out of the top 10 for the sixth consecutive month in July, according to RealtyTrac’s latest report.

"The foreclosure boil-over markets are becoming fewer and farther between as lenders have caught up with the backlog of delayed foreclosures in some of the states with the more lengthy judicial foreclosure process," said Daren Blomquist, vice president of RealtyTrac. Arizona is both a non-judicial and judicial foreclosure state and states with this quasi-judicial status are trending slower and slower foreclosures.

Nationwide, foreclosure filings were up 2%, or 130,888 filings, in July, an increase from the 78-month low in June, but still down 32% from a year earlier.

The monthly increase in foreclosure activity was driven by an increase in foreclosure starts, up 6%, and an increase in bank repossessions, which rose 4%.

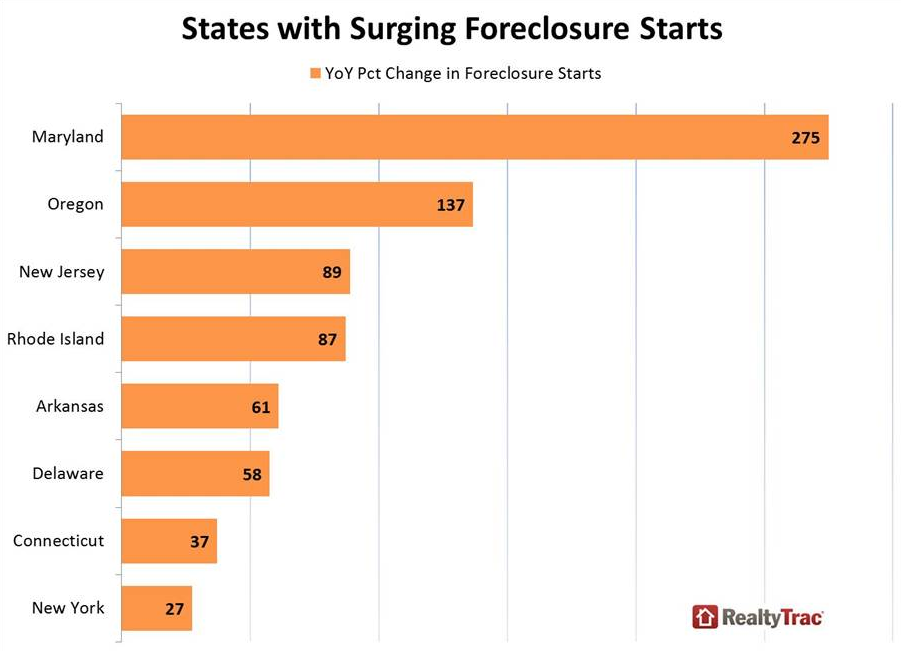

Foreclosures starts increased in 26 states from the previous month, and were also up in 15 states from a year ago, including Maryland (275%), Oregon (137%), New Jersey (40%) and Ohio (20%).

Bank repossessions also increased in 29 states from the previous month, and also rose in 18 states from a year earlier, including Arkansas (266%), Oklahoma (126%), Maryland (101%), New York (100%), Connecticut (67%), New Jersey (40%) and Ohio (20%).

"U.S. foreclosure activity in July is 64% below the peak of more than 367,000 properties with foreclosure filings in March 2010, but is still 54% above the historical average of 85,000 properties with foreclosure filings per month before the housing bubble burst in late 2006," Blomquist explained.

Meanwhile, nine of the nation’s 10 highest metropolitan foreclosure rates were Florida cities.

Florida posted the nation’s highest state foreclosure rate for the third consecutive month in July – one in every 328 units had a foreclosure filing in July, more than three times the national average, RealtyTrac noted.

Jacksonville, Fla., posted the nation’s highest foreclosure rate among metropolitan statistical areas, increasing 19% from the previous month and rising 24% from a year ago.

Nonetheless, there were a dozen states where foreclosure activity levels in July were at or below average monthly levels.

Those states included Colorado, Indiana, Michigan, Oklahoma and Texas.

"More and more homes are now coming on the market from non-distressed homeowners thanks to the snap back in pricing that homeowners have experienced over the past 12 months or so," said Rich Cosner, CEO of Prudential California Realty.

He concluded, "Because these prices moved up in favor of the homeowners, more and more people are now putting their home on the market and over time this will relieve the dire inventory shortage."